To Investors,

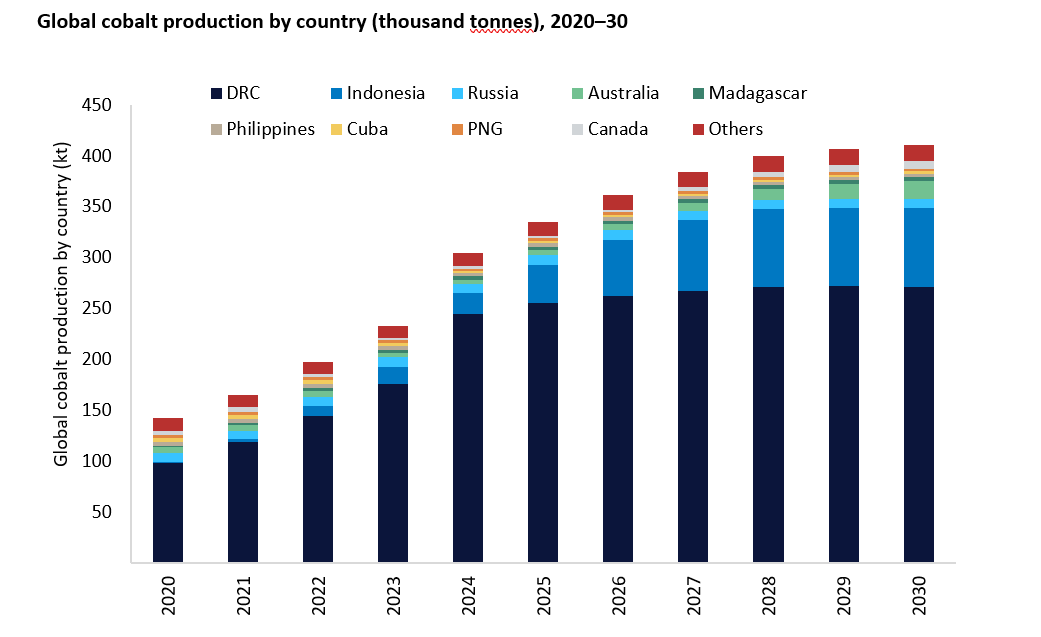

The Democratic Republic of Congo (DRC), which supplies ~75% of global cobalt according to the US geological survey, may be scoring an own goal as they persist with aggressive export controls on cobalt.

Facing a 2024 oversupply glut that drove prices from over $80 000 a ton to near 10-year lows at around $21 000 a ton, the DRC imposed an export ban on cobalt starting in February this year – initially 4 months, and ended up extending the export ban twice to ~8 months total.

This OPEC-style supply control raised cobalt prices by 67% into March this year, and prices have continued to rise, now reaching $48 000 a ton.

In September the DRCs minerals regulator, ARECOMS, decided to end the complete export ban, in favour of annual quotas.

For Q4 2024 the amount of cobalt that can be shipped out of the DRC was set at 18125 MT.

The quota for 2026 - 2027 is 96 000 MT/year. This is well below the 220 000+ MT exported from the DRC in 2024.

So the plan seems to have worked (maybe).

Today, the largest end-use of cobalt – accounting for more than half of global demand – is the electric vehicle battery sector.

DRC regulators felt the country wasn’t capturing the perceived true value of cobalt amid rising demand for cobalt used in Nickel-Cobalt-Manganese (NCM) and Nickel-Cobalt-Aluminium (NCA) electric vehicle battery chemistries. Export controls reduce supply, and raise prices – a perfect short-term fix.

However this isn’t the oil markets circa early 2000s.

A battery chemistry consisting of Lithium, Iron ,and Phosphate (LFP) is also prevalent in the electric vehicle industry.

According to Grok, the world’s leading electric vehicle (EV) producers, Tesla and BYD, are aggressively investing on internal LFP-based battery manufacturing capabilities, moving away from cobalt entirely, with Tesla’s proprietary LFP and BYD’s Blade Battery containing zero cobalt in the cathode.

This move eliminates cobalt for three primary reasons: 1) cobalt is expensive and subject to severe price volatility (peaking close to $90,000/ton in 2022), 2) its mining is concentrated in the politically unstable Democratic Republic of Congo (∼75% of global supply) and is frequently linked to human-rights abuses including child labor, and 3) cobalt-free LFP chemistries now deliver competitive energy density, dramatically better thermal safety, and far longer cycle life than older battery generations of cobalt-containing NMC or NCA formulations.

By removing cobalt, Tesla and BYD achieve lower and more predictable cell costs, reduced supply-chain risk, improved ESG credentials, and batteries that can be charged to 100% daily without significant degradation, making LFP the chemistry of choice for mass-market, high-volume EVs.

Now I’m not a battery expert and while I’m still learning to recognise technological patterns, history suggests that when tech-heavy companies repeatedly disrupt established norms — whether it’s Apple with smartphones, Hitachi or Kawasaki Heavy Industries with high-speed rail, or Waymo with autonomous vehicles — truly transformative shifts often follow.

When two of the most influential and well-capitalised players in the electric vehicle space (Tesla and BYD) are collectively committing tens of billions of dollars to expand LFP (lithium iron phosphate) production capacity, it is reasonable to interpret this as more than short-term cost optimisation. It signals a strong industry bet that LFP is poised to become the new mainstream chemistry for EV batteries.

This potential transition would mark a significant departure from today’s heavy reliance on nickel- and cobalt-based chemistries (NMC, NCA), primarily because, for reasons mentioned earlier, LFP chemistry appears to offer superior benefits for mass scale EV producers. If production scale and energy-density improvements continue, LFP could reset the default standard for a large portion of the global EV battery market over the next 5-10 years.

And that is the DRC’s own goal.

Instead of projecting strength through willingness to work with global partners, the technologically competent players have grown tired of the same political and supply chain risks, and these recent cobalt bans (now export quotas) may be the last straw for the DRC.

It will take time to be able to tell who’s right and to allow market trends to play out, but this will be interesting to watch unfold.

On my journey to becoming a master capital allocator, one lesson down, a billion more to go.

Hope you all have a great weekend

-Mansa

South Africa’s Credit Rating Is Up. Here’s Why You Should Care 👇🏾

I created a quick video to update you that South Africa’s government bonds received a quality upgrade from global ratings agency S&P, and why that matters to investors and to all South Africans.

My Youtube is up and I’m excited to be expanding and adding more awesome content. Please subscribe to my page above and like and share!