To Investors,

Inflation is the most destructive disease known to modern societies. There is nothing which will destroy a society so thoroughly and so fully as letting inflation run riot.

-Milton Friedman

Inflation plays a crucial role in any economy because it encourages consumers to spend money now, rather than later. But it's notable how inflation differs in emerging markets (South Africa, China, India, Brazil) vs developed markets (the U.S, UK, Canada, Japan).

In every economy there’s a steady-state inflation rate (the rate that the central bank of that economy deems as an acceptable rate to ensure consumers and businesses continue to spend money). For example the South African Reserve Bank deems 4.5% to be an acceptable rate of inflation; the Reserve Bank of India targets 4%; and the respective central banks of the U.S., EU, UK, and Canada target a 2% inflation rate.

The steady-state inflation rate is generally higher for emerging markets vs developed markets because of market inefficiencies - i.e. factors that are present in an economy that prevent fair price discovery.

Let's dig a little deeper, using examples from the South African economy.

Mobile internet (Data) prices

In a study run by Cable.co.uk that ranked the cost of 1GB of data globally by country, South Africa ranked 149th out of 237 countries measured. There’s a lot of room for improvement and the reason why progress may be slow is because there are only 2 main mobile internet providers in South Africa - Vodacom and MTN.

Hear me out…

There are actually four notable cellphone network and data providers in South Africa (Vodacom, MTN, Cell C, and Telkom), but Cell C and Telkom are struggling to compete on capital expenditure, and therefore quality.

Cell C offers its own data plans however the company recently handed over management of its physical network to MTN - a competitor of Cell C’s. According to various sources this arrangement allows Cell C to utilise MTN's infrastructure while still maintaining its own spectrum licenses. Essentially, Cell C customers access services through MTN's network. Are Cell C and MTN now collaborators?

That means the companies are no longer competing, so there's a red flag in that arrangement when considering pricing power, and another red flag when considering the quality of services for Cell C customers.

Telkom has a similar arrangement where they use a hybrid strategy including constructing and managing its own network infrastructure in key areas while also piggybacking on Vodacom and MTN’s spectrum. Again, red flag on pricing power and red flag on quality.

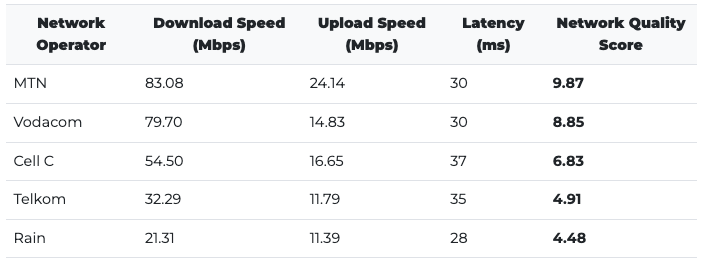

According to MyBroadband Insights’s Q2 2024 Mobile Network Quality Report, MTN and Vodacom are still the main players in the game as they have higher download and upload speeds, and significantly higher network quality scores.

Even if data prices in South Africa fall, they will do so slowly because the only new player in the game over the last decade has been Rain, which was introduced in 2018.

Banking

The banking sector in South Africa has been characterised by monopolistic behaviours since the 1800s, according to a working paper by the South African Reserve Bank that looks at “bank business model identification, evolution and outcomes”.

This paper outlined 3 interesting characteristics of the banking sector in South Africa:

History of banking in SA…

Imperial (mostly British) banks have dominated the banking industry since the discovery of minerals in the country in [the 1800s]. The profits accumulated by these banks were used to further increase their size via the external acquisition of local banks. Banking crises between 1865 and 1890 further reduced the number of local banks, while British banks survived via strong ties to London. By the start of the 19th century, British Standard Bank and Barclays Bank controlled 90% of the industry. This domination of the banking sector led to an increase in rivalry between British and Afrikaner interests, and several financial entities were established to promote Afrikaner interests and participate in the banking industry. The largest conglomerates to emerge were Nedsual [Nedbank] and Volkskas [Bank]. Together with two British banks (Standard Bank and Barclays), these conglomerates have dominated the banking sector post-1994.

Competition in the SA banking industry…

After the Banking Enquiry of 2008 was commissioned by the Competition Authority, the enquiry found that: “Large banks in South Africa avoid vigorous competition on product pricing. Consequently, new banks are unable to compete with incumbents in all but small niche areas. The investigations into banking competition in South Africa did not find evidence that any of the four large banks acted individually as a monopoly. However, the investigations concluded that together the four banks behave as a complex monopoly. In particular, the ability of the four large banks to maintain stable returns on equity over the business cycle pointed to the use of market power to extract desired earnings from bank charges by increasing the charges to make up for any shortfall in net interest income at times of downward pressure. The fees charged by banks were not solely indicative of costs; they also indicated the structure of the industry, market power of the major banks, barriers to entry and difficulties in achieving economies of scale. These inquiries also found that disclosure requirements on interest rates on lending, bank charges and interest payable on savings accounts were not adequate and hampered customers’ ability to compare bank products. The findings also show that the banks implemented complex pricing structures to determine fees, which served to lock in customers and discourage competition.

Consolidation…

As things currently stand, “the [banking] sector [in South Africa] is highly concentrated, with the largest five banks (Standard Bank, First National Bank, Absa, Nedbank and Capitec) accounting for 90% of the banking system’s total assets. The sector has consolidated, with a resultant decline in the number of banks over the past [two] decade[s] from 41 in 2001 to 18 at the end of 2021.”

I encourage anyone who's interested to do their own further reading about the history of the banking sector in South Africa as it is complex, involving multiple mergers and consolidation.

Energy

Historically Eskom had a monopoly on the energy market in South Africa, being the only supplier of energy to consumers in the country. At the same time, Eskom’s largest source of energy has been coal, and remains so, providing over 80% of the energy generated by Eskom.

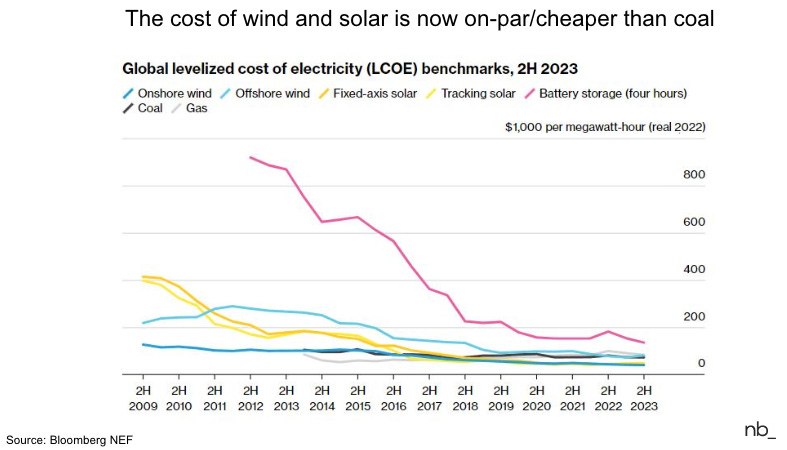

Being a monopoly in the energy market, Eskom continues to burden South Africans with higher costs of energy, even proposing a 44% tariff hike from 2025. That's ridiculous, noting that the levelized cost of alternative sources of energy has also come all the way down, with wind and solar energy costing as much, or even less than coal.

So Eskom is making South Africans miss out on cheaper and cleaner energy.

Now however, with the Electricity Regulation Amendment (ERA) bill passed in 2024, a competitive electricity trading environment can emerge in South Africa, effectively ending Eskom's long-standing monopoly in the energy sector.

Other Goods and Services

A friend of mine sent me a video the other day that talks about the fact that iPhones are relatively more expensive in South Africa.

Why?

In summary, Apple employs independent distributors for their products across regions and in South Africa, there are only two iPhone distributors, Core Group and Asbis. Core Group was the only supplier in South Africa until Asbis came in, only in 2023. Obviously for a while Core Group was charging exorbitant prices for distributing iPhones in South Africa, and with there being only two suppliers, these two companies can (and probably are) colluding to keep iPhone prices high in South Africa.

For these issues above, what’s the fix?

Well for one, things must continue to change on the regulatory side.

For example the Energy Regulation Amendment Bill was a huge step to root out inefficiencies in the South African energy market.

Secondly we need the Competition Commission to work harder to call out companies like Core Group and Asbis for the inefficiencies they are creating.

We also need a much more robust startup ecosystem in South Africa, and a key contributor could be a Startup Act.

Startup Acts are legal frameworks designed to encourage the creation and growth of startups by addressing challenges that new businesses face - such as giving startups tax exemptions, specialised funding access, and enabling simplified regulatory processes.

Benefits of Startup Acts include:

Economic Growth: By reducing regulatory burdens and providing financial incentives, Startup Acts can stimulate economic growth and job creation.

Attracting Investment: Countries like Tunisia have seen increased international investment due to their supportive startup policies.

Encouraging Innovation: These acts often promote technological innovation by creating environments conducive to startup development.

Support for Founders: They typically offer direct support to founders, such as salary provisions during the early stages of business development.

Developed markets tend to have more competition in different industries which forces companies to compete not just on quality, but also on price. Perhaps if the industries mentioned above in South Africa had more competition, then the country might have a lower steady-state inflation rate.

Remember also that inflation compounds annually. So if something costs R100 today, at 4.5% annual inflation, it will cost R104.50 next year, then R109.20 the following year - i.e your purchasing power gets eroded if the growth of your income doesn’t outpace the inflation rate. I wrote about that problem in an earlier note, which you can read here.

I hope you enjoyed reading this letter.

On the journey to becoming a master capital allocator, one lesson down, a billion more to go.

Hope you have a great day.

-Mansa