To Investors

A friend of mine sent me the chart below the other day, which shows the rise in prices of goods and services since 2016 vs the rise in people’s incomes over the same period. Essentially South Africans have lost 44% of their purchasing power since 2016 because of inflation. But the alarming part is that at an average annual inflation rate of 5% from 2016 to 2023 in South Africa, and given the South African Reserve Bank’s (SARB) target of 4.5% inflation as a “healthy” mark, this issue of eroding purchasing power in South Africa will persist.

The accompanying caption for this chart read:

In the last eight years, average net incomes (take home pay) increased by 2% while inflation went up by 46%. This means that in real terms most South Africans had 44% less disposable income in 2024 compared to 2016 due mainly to the impact of high inflation...

What’s the fix?

I don’t have the answers but I have a couple of ideas that I think are worth exploring…

Last Thursday, the SARB cut interest rates by 0.25% from 8.25% to 8%, which will give much needed relief to the economy as this likely signals a new regime of ongoing rate cuts and looser financial conditions.

As an aside, it's important to note that the official calculation for inflation that we see printed in the papers doesn’t consider interest payments - i.e. car loan interest, mortgage interest, and credit card interest; so inflation in South Africa is significantly higher than the 4.4% reported inflation for last month - especially given that interest rates in South Africa are the highest they’ve been since the global financial crisis.

So how do we deal with persistently deteriorating purchasing power and incomes that are failing to grow at a meaningful rate?

Economy

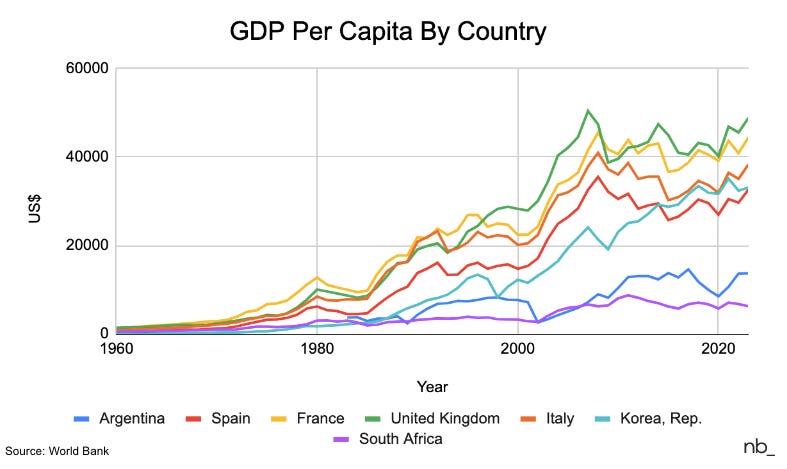

The South African economy needs to grow to a large enough state to meaningfully improve the country’s GDP per capita. The charts below are from a previous letter where I shared my learnings so far while trying to understand the South African economy. You can read more here: An Overview of the South African Economy.

These charts show that GDP per capita in South Africa trails that of countries with similar populations such as South Korea, Spain, Italy, the UK, France, and Argentina.

Higher Incomes

Many would suggest that minimum wage must be raised in the country because inflation disproportionately affects lower income earners, and there may be a strong argument for that, but the reality is that that raises labour costs, and businesses will pass on the higher labour costs to consumers by raising the prices of goods and services, which again causes inflation, so we’d be back at square one.

Rather consider the fact that as an economy grows, and productivity and efficiency improves in the economy, the suppliers of the factors of production (labour included) will be rewarded with higher incomes.

Competitive Advantage

So instead of just raising wages by government decree we should rather ask ourselves: what competitive advantage did China have that helped them go from a GDP per capita of $318 to $12 000 (i.e 40x) in just 30 years? On the chart below you’ll see that in comparison, in the previous 30 years (1960 - 1990) GDP per capita in China only went up by 3x.

On that note, what competitive advantage does South Africa have that could offer a similar solution?

Here are a few key statistics pertaining to the mining sector in South Africa:

South Africa is the largest producer globally of platinum group metals which include platinum, palladium, and rhodium, holding approximately 90% of the world's PGM reserves as of 2022

South Africa holds ~5 million MT of gold reserves, the third largest gold reserves globally

In 2023 South Africa held 600 million MT of manganese reserves which amounted to ~31% of the world's manganese reserves, making the country the largest manganese producer in 2023

South Africa is the largest producer of chromium - producing 18 million MT in 2023. South Africa has the second largest chromium reserves globally, estimated at 200 million MT

It's worth looking at why South Africa sends a significant amount of these resources to be refined in other countries.

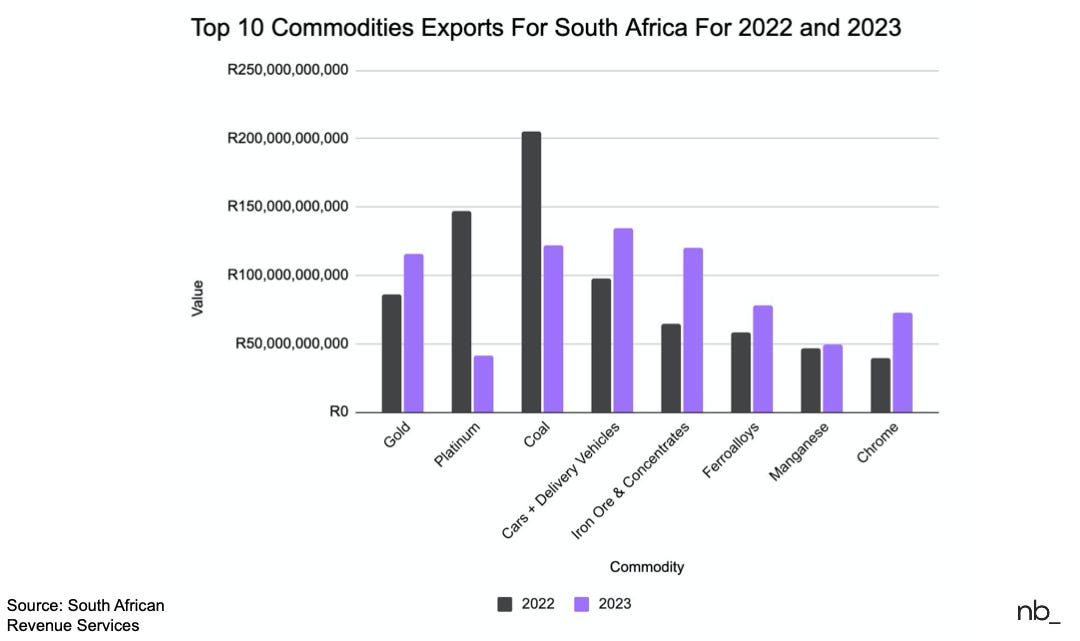

I’ve included a chart below showing the top export commodities for South Africa in 2022 and 2023.

Where is the downstream supply chain productivity in South Africa?

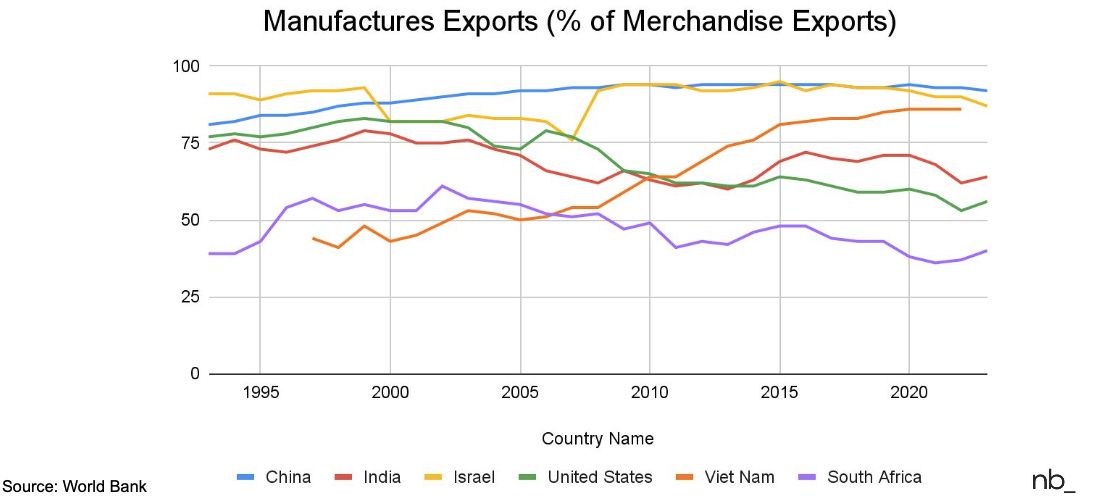

This next chart shows the amount of goods exported in South Africa in 2023 that were manufactured in South Africa, according to World Bank data. In 2023 only 40% of goods exported were manufactured in South Africa, vs 92% in China.

We need to build more things in South Africa.

Skills Development

Since the global financial crisis unemployment has steadily been rising in South Africa, while the economy has also been growing, which suggests a skills disconnect which must be addressed if we're to see any significant economic progress, and reduction in South Africa’s income inequality.

The topic of skills development is talked about a lot in South Africa. If you have any actionable ideas, please share in the comments, let's discuss.

These ideas I’ve shared above may be overly simplistic but I definitely think they’re worth exploring.

The reality is that inflation erodes purchasing power, and there's no way of escaping that because even modest inflation is built into economies to encourage people to spend money now, rather than later.

Rampant inflation is worrisome (which is not something South Africa has) but flat income growth is even more worrisome because it perpetuates inequality.

There’s a large amount of untapped potential for growth in the South African economy.

I’m excited to build and be a part of a generation that can unlock unbelievable economic growth and prosperity for a broader group in South Africa.

In my previous letter I attached a slide presentation of my learnings so far while studying the South African economy. Check it out on this link: An Overview of the South African Economy.

I hope you enjoyed reading this letter

On the journey to becoming a master capital allocator, one lesson down, a billion more to go.

Chat soon,

-Mansa