To Investors,

In 1969 Berkshire owned a bank called the Illinois National Bank & Trust Company, which was one of the largest banks in Illinois at the time. In his short tenure as the owner, this bank became one of the most profitable banks in the US.

In 1970, the US passed the Bank Holding Company Act, which mandated that Berkshire had to choose between being a bank holding company or being an investment firm - they couldn't do both. The rest is history.

Buffet has mentioned that if it weren’t for the Bank Holding Company Act, he would have bought a whole bunch of banks in their entirety, instead of insurance companies.

Over the years he’s invested in a variety of bank stocks, but he now mostly only has holdings in Bank of America - valued at over $28 billion.

But what’s so special about banks, or insurance companies, for Buffet?

One word: Float.

In the context of insurance companies, float is the money that an insurance company gets to hold onto between the time customers pay premiums and the time they make claims on their policies.

Float is free money because most people never make a claim on their insurance policies, so the float continues to grow for the insurance company. Month over month, year over year.

Think about how if you’ve had a car for 10 years and paid a monthly insurance premium of R1000 a month every year, with no breaks, to your insurance policy provider. You’ve gifted that company R120 000 over the 10 years.

Banks can be seen in a similar light as an investor. As a bank, people request that you take their money, and even pay you (in banking fees) to take their money. Everyone keeps their money in a bank for extended periods and never really request to withdraw any significant amounts.

Buffet’s genius is his ability to take calculated risks in using that float to make high return investments. That’s why over the years (because he couldn’t buy banks) he bought National Indemnity and GEICO in their entirety, among other insurance businesses.

In our previous letter titled “Why Does Warren Buffet Like Apple and Coca Cola?” I mentioned the fact that Buffet picks companies to invest in by choosing the most recognisable brands, which are also the category winners.

Well, this is even more important with banks because the idea of you requesting and paying the bank to take your money solely relies on the bank’s brand. Why do you use your current bank?

Bank of America

Bank of America was originally started in California as the Bank of Italy in 1904, catering to the underserved Italian immigrants in California. Through a series of mergers, Bank of Italy became Bank of America.

Fast forward to 1958 - to what became known as “the drop”.

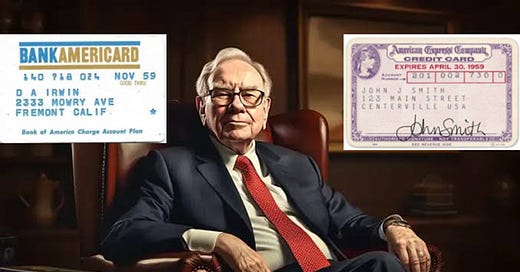

Bank of America sent 65 000 rectangular plastic cards, unsolicited, one to each of their customers in the region.

Titled BankAmericards, these plastic cards would allow holders to shop at selected stores on account and pay the account at a later stage. The BankAmericard program was the beginning of credit cards and was licensed by Bank of America to other banks across the US. The need to manage the credit cards across regions required a separate and independent entity, and that's how Visa was born.

That short story was necessary to highlight the fact that Bank of America is the most recognisable name in banking in the US. Today Bank of America is the second largest bank by assets behind JP Morgan Chase.

I compared JP Morgan, Bank of America, and Wells Fargo (the top 3 largest banks in the US) based on a few metrics to see if there was a numerical reason for why Warren Buffet loves Bank of America more than the other banks.

There isn't.

There is no metric where Bank of America stands out. Even based on Net Interest Margins, the national average Net Interest Margin for US banks from Q4 2014 to Q4 2023 is 2.86%. Wells Fargo, Bank of America, and JP Morgan Chase came in at 3.01%, 2.71%, and 2.08% respectively.

Buffet’s love for Bank of America then likely also has to do with safety. Buffet has often spoken highly of Bank of America CEO Brian Moynihan, including his integrity.

Between the housing financial crisis in 2008, Wells Fargo’s fake customer accounts scandal in 2016, and the banking crisis which resulted in the collapse of Silicon Valley Bank in 2023, Buffet seems to like the safety of Bank of America as a trusted brand, with a level-headed CEO.

Lesson learned: There’s more to a company than just the numbers.

American Express

I mentioned how the BankAmericard program allowed members to buy goods on account and pay for that account at a later stage (how credit cards work today).

Well, American Express ran a similar playbook to the BankAmericard program, but not so much on the banking side in the company’s early days.

American Express was founded in 1850 as a freight forwarding company. In 1852, the company expanded its services to include money orders, which allowed customers to send funds to distant locations without the need for physical currency.

This innovation helped American Express establish a reputation for reliability and trustworthiness in handling financial transactions.

In the 1950s American Express (Amex) evolved to become a charge card network business. This card allowed cardholders to make purchases within the Amex network and pay the balance in full at the end of each billing cycle, effectively functioning as a charge card rather than a traditional credit card. These services however were offered only to Amex “club” members. There’s a prestige that comes with pulling out your American Express card to charge a bill.

Over time, the American Express Card became one of the company's flagship products, and American Express expanded its offerings to include a range of charge cards, credit cards, and financial services.

The magic of American Express lies in 1) the concept of float, again. In this instance people pay to become an American Express club member; 2) relating to the charge cards - humans are humans and when people have a tab, they’ll be sure to run it up. Have you ever kept a bar tab open and was surprised at the bill when you closed it at the end of the night? 3) egos - being an American Express “club” member is exclusive and implies prestige. People will always pay for exclusivity.

Some takeaways for the next Buffets of the world…

Remember that there’s more to a company than just the numbers.

If you can’t have a controlling stake in a company, rather invest in the company that is the category winner (highest quality brand), has great management, and will give you the best returns as a silent stakeholder (high dividends, steady and high Return on Equity).

P.S - note that it takes more than a decade to build a quality brand.

Respectfully,

-Mansa

READER NOTE: If you liked this post, feel free to hit the subscribe button and share with someone who might also find this interesting.

What did you think about this letter? Let me know in the comments 👇🏾

Disclaimer: this note is not financial advice and is for informational and entertainment purposes only. We may hold positions in the companies discussed. Do your own research.