The crypto markets have been slaughtered over the last 8 months. Bitcoin and Eth are down over 70%, the DeFi space has lost over 60% in total value locked, and once-loved projects such as Luna are all but dead, arguably so are crypto focused investment firms like Celsius and 3AC.

As with anything in the world there is good and bad. Some argue that a lot of crypto projects are/were scams and are worthless, including bitcoin and ethereum, others are staunch supporters of most crypto projects - but the problem is no one is realistically defining most of these projects and what the intended use case is.

14 years after bitcoin was first introduced to us, we’ve seen two relatively small countries (El Salvador & Central African Republic) adopt this digital currency as legal tender in their respective domestic economies. However its time for a real chat about whether bitcoin can actually replace fiat currencies. I don’t think bitcoin can scale to that level of use case, mainly because of human behaviour and Keynesian economics.

Keynesian economics is an economic theory that arose in the 1930s that basically says governments need to intervene to stimulate demand in an economy when necessary. This is how all economies are run around the world. The theory was expanded over time to include central bank influence on economies, to where central banks found that they could intervene in markets to stimulate demand by lowering interest rates and increasing the money supply in an economy. The inverse is also true - where demand at times must be cooled by governments and central banks.

National governments and central banks have been running this playbook to varying degrees for decades - for example during the great depression, Black Monday, the Global Financial Crisis, and more recently with the covid-19 crisis.

On the human behaviour side, people like to take risks in search of greater returns, or even simply improving our lifestyles. So we lever up trading accounts, we finance the purchase of cars, houses, other property, and we take on loans for personal expenditures (credit card debt) and business expenditures. The use of credit plays quite a large role in any economy.

In a simplified manner there are 3 main factors that are always at play in any economy: productivity growth, the short term debt cycle, and the long term debt cycle. The overall influence on those 3 factors is human behaviour, and the way people behave determines

the level of productivity in an economy.

The state of the short and long term debt cycles

Productivity: this is the the amount of goods and services produced - measured by the change in the amount produced from one period to the next.

Short term debt cycle: this is a period in an economy typically lasting 5-8 years, during which people use credit to supplement spending. Credit is made available to consumers and businesses by a country’s central bank - through commercial banks (Absa, BoA, Wells Fargo, etc). During a period when credit is easily available lenders are wiling to lend more and borrowers a willing to borrow more. Here:

the demand for goods and services increases, supplemented by the availability of credit

generally productivity increases to meet demand

because spending is increasing, incomes increase, creating more credit worthy consumers who in turn borrow more money.

Those people also want to buy more goods and services, and the wheel continues to spin.

Because spending is made up of cash and credit, we end up with an increase in prices when credit increases too quickly.

Two things to remember are 1) spending drives the economy, and 2) if someone is spending, someone else is earning. So if people are buying goods and services, the economic machine is moving along normally. When things are good (businesses are making money, personal incomes are increasing, prices of goods and services are stable) we generally take on credit to increase productivity.

More money can be made available by the central bank faster than the rate at which new goods can be made to meet demand. Therefore, as the supply of credit increases in an economy we end up with too much money chasing too few goods. Prices start to increase as consumers bid up the price of existing goods and services. This is inflation.

Looking at a picture of how cycles generally look, inflation becomes higher as we move up the slope during the short term debt cycle, and must be controlled to prevent overheating inflation and falling demand. In a fiat system a country’s central bank will fight inflation by

raising interest rates (making it more expensive to borrow), and/or

reducing the rate at which new money is introduced into the economy.

This reduces demand for goods and services and brings down prices. A deflationary period sets in where economic activity is falling as people spend less because they have higher debt repayments, and don’t want to borrow more.

As we move down the slope of the cycle, on the other side of peak credit demand and inflation, inflation falls to a more manageable level, and because the central bank doesn’t want economic activity to get too low, the central bank will stimulate the economy in an effort to entice people to spend more.

A central bank does this by

cutting interest rates (making it less expensive to borrow), and/or

increasing the rate at which new money is introduced into an economy.

The cycle is complete and economic activity starts to pick up again. Those ups and downs in availability of credit and in the levels of economic activity play out over a longer period that creates the long term debt cycle.

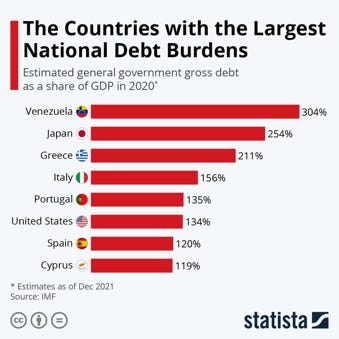

Long term debt cycle: typically lasting 50-75 years, the peak and the trough of this cycle are usually more intense than the peak and trough of the short-term cycle. As the short term debt cycle plays out where debt levels move up and down, the bottom of each subsequent trough is roughly higher than the peak of the previous cycle. The reason is that people are generally inclined to borrow more rather than to pay back more. This is human nature and it means that 1) debt levels are always rising in an economy and 2) over the long term debts are rising faster than incomes.

Over the long term, lenders continue to lend more, and borrowers continue to borrow more because everyone feels good. Asset prices (cars, real estate, the stock market) continue to go up so borrowers feel more credit worthy as the value of their holdings and collateral goes up, so they continue to borrow more.

This however, is unsustainable because at some point debt repayments will start to grow faster than incomes, which will cause people to spend less. Less spending = less incomes = less economic activity = less spending =… and so on.

At the peak of the long term debt cycle the burden of debt is too high. This happened in 1929 in the US, in 1989 in Japan, and in 2008 in the US and rest of world.

During this period a deleveraging period begins in an economy, characterised by:

less spending and less demand for assets as liquidity becomes more important

falling incomes caused by reduced spending in the economy

less availability of credit as the value of borrowers’s assets and collateral drop

fall in asset prices

economic activity falling to a near stall

We saw this most recently in 2008, and 2020.

United States Fed Funds Rate

United States Consumer Spending

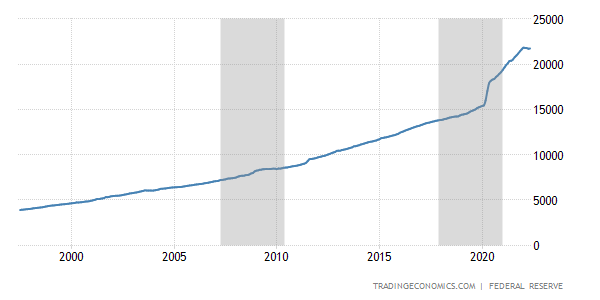

United States M2 Supply

United States Housing Index

S&P 500 Index

When an economy is in this situation, more drastic measures are required to support the economy, such as fiscal stimulus from the national government and more intense monetary stimulus form the central bank.

Typically the national government, through its treasury, borrows money by issuing government bonds, and spends that money on policies such such infrastructure and other projects that are intended to support the economy by subsidising production costs for businesses and allowing them to increase their productivity.

The central bank in turn usually needs to increase the supply of available money in order to afford to lend money to the national treasury for the government’s stimulus projects. Additionally, depending on the severity of the problems in the economy, and because economic activity has slowed and therefore businesses aren’t making any money, some businesses are under threat of defaulting on their loans and going bankrupt. Because that would cause a cascade of additional problems in the economy, the central bank also steps in to buy those loans and effectively allow those businesses additional runway in a debt restructuring process. Again the central bank typically increases the available supply of money to be able to afford to support the economy in this way.

Obviously the economy is much more complicated than was just described, however the point of discussing the long and short term debt cycles was to highlight the importance for a central bank in an economy and for the central bank to be able to control, increase, and decrease the supply of money in the economy, hopefully in a controlled and systematic manner.

So is it possible for an economy to function using bitcoin as its currency - a currency with a fixed supply of 21 million bitcoins at last mine?

Charts Showing M2 Supply In the US, South Africa, and China Respectively, Over Time

Human behaviour and Keynesian economics show us that a fixed currency such as bitcoin cannot replace fiat currency in a domestic economy.

In fact, we’ve already operated in a similar situation before, with gold and the gold standard. Because gold has a relatively “fixed” supply as well, from 1944 to 1971 as the demand for US dollars grew after the Bretton Woods Agreement the Federal Reserve Bank made more US dollars available - straining the original US dollar-to-gold peg. When countries started trying to redeem their dollars for gold, the US government effectively defaulted by declaring in 1971 that dollars would no longer be redeemable for gold. So really a currency with a fixed supply doesn’t work.

In times of crises (over short and long term debt cycles) the US has had to act to support their domestic economy. The persistent debasement of the US dollar is a similar playbook that a country like Nigeria or Thailand would run to devalue their respective currencies in the case where the currency peg is under heavy pressure. Most countries that use a fixed exchange rate system use devaluation as a monetary policy tool.

One of the main benefits of devaluing a currency is that it reduces debt repayments for a government with sovereign issued debt. For example if a country’s debt repayments are $5 million and the currency is devalued by half, debt repayments will be reduced to $2.5 million.

As fragile as the US dollar is, it is still the world’s reserve currency and the global trade currency - largely because the world is used to the decades old system.

Instead, what could likely happen is bitcoin replacing the dollar as a global reserve currency in the interest of national security, and in the interest of maintaining stability in pricing of goods and services denominated in a currency with a fixed supply like bitcoin.

I don’t know what that would look like, but perhaps we go back to a quasi-gold standard where each world currency is pegged to bitcoin. However, that’s a discussion for another time.

For countries with less stable or failing currencies bitcoin might be a good alternative because on top of giving the country access to a globally recognised and supported currency, bitcoin will introduce the country to a global digital network, and allow the country to up-skill its residents as they have to learn how to create in and transact for the digital economy.

For the CAF (which used a largely unrecognised Central African franc) and El Salvador (which originally used USD) I suspect the larger chess move is that these economies are aiming to attract foreign investment as each country up-skills and also aims to become a respected participant in the global digital economy.

However as demand for goods and services grows in those economies, and the economies mature, it is likely that countries using bitcoin as a currency will need to re-create a strong sovereign currency to be able to issue debt and support the economy as needed and described earlier in this piece. Perhaps the end game is a currency that is backed by something more predictable in supply such as bitcoin, but it will be extremely interesting to watch how bitcoin is actually used around the world by more mature economies. I'm mostly looking forward to the day when we can be certain that the crypto industry has matured and crypto projects are defined clearly and realistically.