You would expect larger economies to be among the first to develop bitcoin strategies at the national level - especially the larger African nations. If not the top 3 largest African economies, then at least either Kenya (huge into fintech innovation - crypto is the natural next thing to integrate), or the rest of the top economies (all as simple ways to drive innovation within their borders).

But the bigger the country, the greater the political complexities it seems, so I’m not surprised it was a smaller nation that was the first African state to adopt bitcoin as legal tender. This is huge for the Central African Republic.

Population ~ 4.8m people

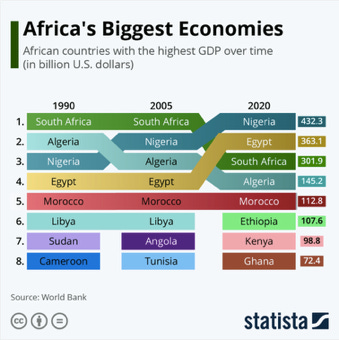

GDP has averaged ~ US$2.3B over the last 10 years (look at the chart above for context).

But speaking generally, for any country, adopting bitcoin will lead to a country-wide general crypto onboarding. The reason being that there will need to be

infrastructure built to support bitcoin and crypto transfers (apps, exchanges, etc)

Bespoke blockchain technology and decentralised apps (dApps) to enable record keeping (applications to systematically record the public use of bitcoin)

Mass education about crypto for citizens and institutions

Government funded programs to create continuous crypto innovation from the school level to the professional level.

I always find it impossible to talk about bitcoin without bringing up wider applications that came about because of bitcoin. That is the broader crypto space, which includes NFTs, broader web 3 and dApps, DeFi, but most important and underlying all of that innovation is blockchain technology.

The greatest problem that blockchain solves is that of trust. Traditionally we rely on institutions such as central and commercial banks, corporate boards, and governments to enable us to transfer value and we trust that they are relaying accurate information to us. The problem with that is we are entrusting institutions that are controlled by humans and humans are susceptible to corruption. We therefore can never be 100% certain that data from these institutions is 100% accurate.

With blockchain we are instead putting our trust in software code, which is essentially math. You cannot bend math to your will. It will return the truth with 100% accuracy. This is one of the largest benefits of adopting bitcoin.

The CAR adopting bitcoin as legal tender will be brushed aside at first because its a small African country, but the bigger picture is that there is a snowball effect slowly gaining momentum. Essentially this is now becoming a macro game theory situation. The country that invests the most in bitcoin and crypto will be a large player in the global arena.

Bitcoin is a form of high technology that has earned its stripes as the crypto with the longest track record for high return on investment and the longest track record for sustained 100% functioning, holding up its sound-money principles of

scarcity

store of value

medium of exchange

traceability

transparent and auditable supply

accurate decentralised ledger.

We’ve seen how Russia and affiliates were cancelled from the global financial system. Right or wrong, the US led these efforts through coercion and “no one [country] should have all that power” - Kanye West. Any country that is not the US or China must support crypto. In other words if you do not control the US dollar (global trade currency) or the Chinese Yuan (closest US dollar competitor), it is in the interest of your national security to protect your economy from coercion.

I’m not saying bitcoin should replace all fiat, but the leader of any nation should think about bitcoin and crypto like this:

Crypto is a trillion dollar industry - you want that as a part of your country from an economic standpoint

If you support crypto your country cannot be de-platformed. (e.g with Russia, Iran, Afghanistan, or be excluded from SWIFT which is largely influenced by the US alone).

Capital inflows

If you self-custody, Bitcoin and other decentralised cryptos are seizure resistant assets - promoting personal and national security (cannot be de-platformed, or threatened with sanctions, or have assets seized).

Bitcoin is the most sound form of money we have ever seen. As a gold 2.0, having bitcoin reserves in addition to traditional gold and other reserves improves the belief in the solvency of the domestic currency.

Crypto adoption at the national level is a signal of competence in high-technology.

Those that become wealthy from crypto worldwide will want to deploy their capital somewhere - a country that supports crypto, thereby signalling competence in high-technology, will be an attractive investment to deploy capital into

The influx of capital (foreign investment) will lead to growth in demand for the domestic currency or domestic goods and services - boosting the broader local economy,

again this leads to nationwide crypto onboarding as mentioned earlier, which leads to more foreign investment, and more capital for infrastructure development - and the cycle continues.

Crypto enables a remote economy - a software systems based country can become an exporter or world leader in business process services (see point 6), and remittances - i.e an exporter of digital technology. Crypto works across borders so you can have citizens working remotely and being paid to enable remittances and develop other innovations to solve more problems

Strengthen monetary policy - the country’s Reserve Bank will have an asset that is digital gold, in reserves, backing the local currency

Mathematically provable accounting

The Big 4 accounting firms use the bitcoin blockchain and other blockchains as north stars for truth when they are auditing firms that engage in crypto transactions, because

a blockchain gives corroborating confirmation - a third entry - not just your debit and another company’s credit when you do a payment, but a third entry which is cryptographic and cryptographically verifiable, and immutable - therefore shows 100% accurate history of who paid who.

This allows all kinds of accounting to be automated - not just relying on the company’s books and manually updated spreadsheets.

The more data that is on-chain, the more you can automate.

Additionally blockchains allow you to do proof-of-reserves - certifying if you have the needed assets on hand

Crypto is the financial internet

Derivatives, lending, and other financial services are being built on crypto platforms, so

you want those services as a part of your domestic economy. You don’t want your population to have to learn decentralised finance from scratch - where in some cases they are already struggling to understand traditional finance. You need them to have knowledge of the financial internet - you need that in your country otherwise you risk the country being left behind economically

Crypto is the open source alternative to foreign corporations

Sick of foreign involvement and foreign corporates profiting more than domestic corporates? - go crypto.

Blockchains are open source - you can see the source code, you can analyse the database - unlike with centralised services.

You can build on top of crypto source codes and create domestic APIs - enabling growth in the wider domestic technology sector, and creating a positive impact on other sectors

If you are not the US or China you won’t be able to coerce people into using your currency or partnering with you on a project or any national agenda, you need to convince them

Adopting bitcoin and other crypto initiatives convinces people (see point 3).

Crypto also allows countries to align on factors which promote non zero-sum outcomes such as peace, prosperity, decentralisation, inclusion, and freedom of choice

Nationalism is fine but you need to have something that signals being open to international collaboration - crypto does that because crypto is borderless.

Bitcoin adoption either through only holding it on the balance sheet, or using it as legal tender in a country does more for the people of that country than you might think at first. Arthur C. Clarke once said “any sufficiently advanced technology is indistinguishable from magic.” This is bitcoin, this is crypto. The underlying technology allows people to gain financial freedom, allows wider inclusion in the financial system, and allows people to explore and come up with even greater innovations. So its really not just about bitcoin, its way more than that.