The idea of international allies has been around for centuries, and has evolved over the years. Traditionally it has always been most beneficial to be an ally with a country that has a large influence on the world based on military might and/or financial or policy-based influence on global trade. Nowadays I think we should add another dimension, because the most influential countries are likely those that are also heavily digitally developed. This means having the most advanced digital technologies being built in and underlying most or all of the infrastructure in the country. India is an example of such a digitally advanced nation, and I think all developing nations should be allies with India (politics aside).

In 2009, it was estimated that about 400 million Indians didn’t have any sort of individual identity document or identifier . On top of that, only 17% of Indian adults possessed a bank account, meaning hundreds of millions of people were cut off from the formal financial system. This means India was missing out on a lot of potential productivity, tax revenue, and socio-economic development.

In a letter written by Aaryaman Vir and Rahul Sanghi on a Substack called “Tigerfeathers”, the authors describe three primitives that are most important in the digital world. These are identity, payments, and data. Implement these at scale, and the limits to where innovation can go are undefined! This is one of the great things about crypto that seems to be under appreciated, but we’ll get to that in the third and final chapter of “The Other Internet Country”.

In 2009, the Indian government decided to try to service these three primitives, as the government (through a think tank called iSpirit) embarked on one of the most daunting tasks ever implemented at the national level - the mission to digitise an entire nation, and create a digital footprint for every citizen. This initiative became known as India Stack - which is a set of national APIs which developers can build on top of and provide any social, corporate, or government applications.

The product rollout for each of these layers is simple, yet mind-blowing because the products are obvious and make sense, but also they are implemented on a large scale so its quite amazing to see that they actually work and provide a lot of internet-like benefits.

Identity Layer

Aadhaar

As a part of the Identity Layer of India Stack, Aadhaar allows anyone to get a digital identity. All they need to submit is their name, gender, address, birth date, and biometric data (finger print, retinal, and facial scan)

Anyone who already has an ID document can apply for an Aadhaar account as well

Introduced in 2009, the mission of this product was to give every Indian a foundational digital identity. Once people had an identity that could be easily traced and verified, it became easy for them to get bank accounts

In 3 years from the launch of Aadhaar, 600 million bank accounts had been created, and 250 million by new-to-bank customers

5 years after Aadhaar was launched more than 1 billion Indians had received an Aadhaar card*

By 2021, 1.27 billion Aadhaar cards has been issued, more than 94% of the country’s population

*the actual card doesn’t serve a purpose, a person can simply provide their 12 digit Aadhaar number to a host of service providers

Benefits

For individuals:

e-authentication using a fingerprint scanner - available at most merchant and other locations in India.

Data protection - Aadhaar also allows 2-factor authentication where a one time pin is sent to your mobile or email address when a request for your data is made

For businesses and individuals:

e-KYC through Digilockers - a system of personal cloud lockers that uses Aadhaar to link, fetch, and store digitally signed copies of important documents like income tax documents, driver’s licenses, insurance policies, educational diplomas

e-Sign - a standard that allows any Aadhaar holder to generate a legally verifiable digital signature

Reliance Jio (largest cellphone network provider in India) on-boarded 100 million users through Aadhaar. The e-KYC verification process took 5 minutes vs days before Aadhaar was introduced

The World Bank estimates Aadhaar e-KYC brought down customer onboarding costs for an Indian Bank from $23 to $0.15. Making it economical to open new accounts for poorer customers

Allowed many private banks to be developed across India

Possibilities created by Aadhaar

Since everyone has a digital identity, identities across the country are easier to track, and service providers can provide financial services, civil services, etc. but,

Social media and other app developers can an build on top of Aadhaar to create platforms that have humans only, no bots - because every account will be verified

A digital poling system can be built and run effectively

As a developer;

you already have easy access to all data in the country - meaning you can easily understand behaviours and trends and build to service that readily available data.

you can easily create interoperable applications because the code on which India Stack is built is standardised,

no need to build multiple interoperability protocols to service different applications

Data protection polices become easier to implement because the user is aware of the data that is being used, additionally the government can also better police the use of data for certain applications

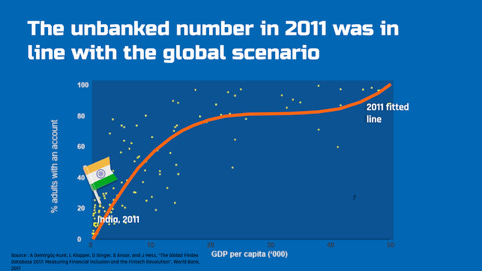

The impact of Aadhaar is measured below. The argument here is that the penetration of financial inclusion is directly linked to an increase in GDP.

By 2018, India became an outlier. This level of progress should have taken 46 years, but only took 7 years.

Payments Layer

Now that most Indians have bank accounts, courtesy of Aadhaar, they needed to have access to transactions systems that have low fees and are extremely relatively easy to use. Because some 400 million Indians were introduced to the Internet through a smart phone thanks to Reliance Jio (topic for another day), it made sense to introduce a fast, cheap mobile payments system for the population.

In that light, Unified Payments Interface (UPI) was formed.

Launched in 2016, 4 years later UPI grew to the 5th largest payments network in the world by volume - only behind Visa, WeChat Pay, Alipay, and MasterCard.

Built by a consumer internet company, essentially UPI is a standard software protocol on which all Indian banks and other financial intermediaries have to run. In 2021, 200 banks were connected to UPI, and this makes it attractive to build great fintech applications. As a fintech developer you can develop products more easily, and these products will scale at a rapid pace because all banks run on one protocol. You therefore don’t need to form bilateral relationships with each bank, and build apps that have different standards, and you can simply focus on customer acquisition, product innovation, and providing the best possible user interface and user experience.

Other benefits of UPI

Real time payments

B2B, C2C, C2B payments

Offers a Virtual Payments Address (VPA), that people can use to pay/send money to each other, e.g “mansasithole@upi”. So no need to remember a string of account numbers to send to people, running the risk of typos and lost funds - you just need to remember your simple payments address

Due to the interoperability that UPI allows, users of any UPI based app can pay users of another UPI based app instantly - so people can choose the product that best suits their needs, without worrying about possibly being cut off from their friends or other financial networks.

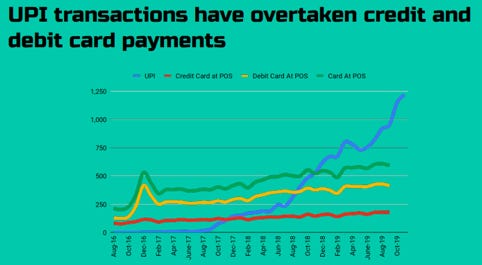

The impact of UPI:

As at 2020, UPI’s monthly transaction volumes were growing at 2.2 billion, 10% month on month

$54 billion in monthly transactions ~ $648 billion annually - 25% of India’s GDP

A set of integrations was introduced to UPI which allowed payment apps to allow users to subscribe to IPOs, purchase stocks, mutual funds, and other financial services

Most popular mode of payments

Data Layer

After getting digital identities and efficiently exchanging information through Aadhaar, Indians were introduced to simple and fast digital transaction apps through UPI. This meant that Indians were continuously creating large amounts of data. Remember that saying “data is the new oil”? The third layer of India Stack looked to capitalise on that valuable data. This layer is called the Data Empowerment and Protection Architecture (DEPA).

In a sentence, DEPA is a policy framework that defines how the economic primitive of data can be freed up so that individuals and businesses can choose how to best protect it and use it for their own gain. This innovation, which is presently being rolled out in the financial services industry, has its philosophical roots in a piece of impending legislation known as the Personal Data Protection Bill (PDP)

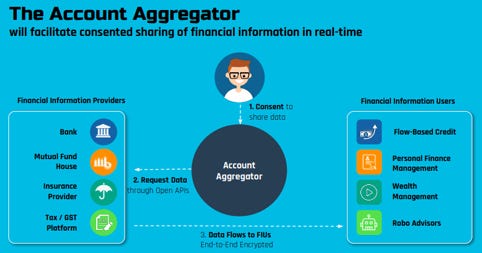

To facilitate the transfer of data, India introduced financial intermediaries which they refer to as Account Aggregators (AA). They act as consent managers to transfer user data between different entities - only after receiving consent from the owner of the data.

How it works:

A user downloads an account aggregator (AA) app, then

uses their mobile number to link their bank accounts, credit cards, loan provider accounts, stock broking accounts, insurance policies, and many other financial instruments.

Once these assets have been linked, the user can begin providing consent to share data with third parties.

Because consent can be approved or rejected on the AA app, if you want to open a new loan account from a financial intermediary for example there’s no need to upload documents every time you want to open a new account. Instead:

Using your simple UPI address, the lender sends you a request for your data using the AA app on your phone

The request contains explicit information about the data requested (size, purpose, for how long, and how frequently)

After providing consent, the signed data sharing agreement is shared with your bank, which provides the lending company with the consented data

Your work as the user is done.

In a nutshell this is what the process looks like

Benefits:

The AA interface provides a single location to view, manage, and revoke all consents

Data requests are clearly defined and can be approved or rejected with one click - no longer need PDF uploads, scanning of photos, etc.

Account Aggregators provide a more secure way of transferring your data. One source and interface, instead of exposing your bank account and other details to every website on the internet

Granular data sharing, e.g

a user doesn’t need to share their entire bank statement, just an average balance, or

just transactions at hotels that cost above a certain amount - to show affordability

Benefits for service providers:

authenticity, interoperability, and lower costs

Data comes directly from a bank or other trusted source that a user has signed up for

No risk of doctored data - data is digitally signed by the user

The entire AA system is interoperable by design, meaning any AA app can make data requests from any other AA app - removing the need for extra protocols in an effort to interoperate with different apps

Data already comes in machine readable format

What this means is that the efficiency with which data is shared and the standardisation of infrastructure in India allows for the creation of more products and services which service smaller consumers. These can be things like smaller loans, but with near instant approvals.

When smartphone penetration is at 100%, and everyone is transacting and communicating digitally, all businesses will have digital transactions in some form - even hawkers, local butcheries, and the like. Things like Aadhaar, UPI, and the AA system can facilitate these transactions. The end case could be businesses being able to leverage their recurring revenue to grow faster - like what PIPE is doing for businesses in the United States.

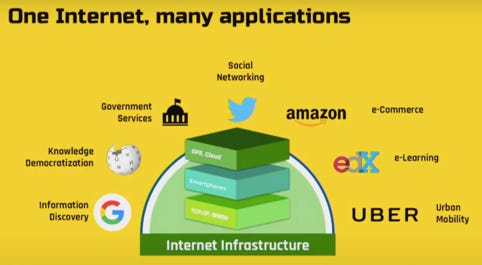

Zooming out, think about it like this; the larger the amount of data a company/institution has - the more power (re: ability) it has. Being data rich is one of the most important things for any company/institution these days. Think about the many different products that the internet has been able to provide, or the potential energy (measured in driving miles) that Tesla is going to deploy to give us full self driving, or the success Facebook got from leveraging data. In a similar manner, India Stack has made India data rich. This is what it looks like,

The stack that includes website building protocols, smartphones, GPS, and cloud gave us the ability to create and use a host of digital products like Google, Amazon. Uber, etc.

In a similar manner, the India stack that includes data, digital payments, and digital identity protocols is giving Indians the ability to offer a suite of products servicing health insurance, education, financial inclusion, lending, and more.

Additionally, as I had mentioned in the first part of this series, investment in high-technology is a signal of technological competence, which attracts foreign capital into a country. The result of India stack is that since 2016, $12.2 billion in VC investments have gone into Indian startups. In comparison, since 2016 only $410 million of VC money has gone into South African startups in total.

So what’s the point?

Aaryaman Vir and Rahul Sanghi couldn’t have said it better:

The point is that the philosophy behind India Stack can be instructive for the world at large, here and now. This decade-long socio-economic experiment has proved that you can balance innovation and inclusion without compromising on your economic principles. The results have demonstrated that aside from the Invisible Hand in the US, or the regulation-led strategy in the EU, or even the Great Firewall of China, there is a [new approach] to development in the digital era and it is being pioneered in India.

I’m simply adding to that by saying South Africa can make up for this lost decade and troubling youth unemployment by becoming allies with India in an effort to build similar product for the people of South Africa. As you standardise the infrastructure on which digital systems are run, you make it easier to build applications - surely there will be a lot of people more willing and now quite able to build scalable applications. Entrepreneurship booms, education booms, foreign investment booms, GDP booms. Not a difficult effort, just requires the right leaders and monk-like focus.

Had there been a payments system similar to how UPI works, and available to the entire South African population, perhaps stimulus payments during the covid-19 pandemic could have been delivered better - straight to mobile wallets, from the central bank. Maybe even other transfer payments like social grants can be delivered straight to mobile wallets, avoiding long queues at financial intermediaries or other locations acting as intermediaries - also completely eliminating the need for long commutes to collect these transfers.

But we’re already seeing other regions following in India’s steps

On the identity front, an open-source organisation called MOSIP helps governments [around the world] implement national ID schemes using the learnings from Aadhaar. Morocco and Philippines are two countries in the most advanced stages of implementing these systems, but several other states like Sri Lanka, Ethiopia, and Guinea are in the pilot phase

I’ve listed some insights which give a picture of the state Aadhaar, and users’ perception of the system.

Naturally there will be problems with these types of systems, mainly centralised data, lack of education, and actual internet connectivity. But these again are simple to solve, but also hard to solve at the same time. It wont be easy, and there are many challenges that will be faced, especially given the magnitude of the scale at which these technologies will need to be implemented; and the required alignment between different entities (the likes of which we’ve never seen in South Africa). However if it works, South Africa can find itself lifting the economic state of the population, becoming an exporter of digital services, and following India’s lead to become The Other Internet Country. In the final series I’ll talk about how crypto can possibly be integrated into an India or South Africa Stack, and the benefits of that integration.