In the first piece of The Other Internet Country series we talked about the importance of crypto investment at the national level. We looked at the importance of buying bitcoin to put on the national balance, and the snowball of crypto interest and investment that would result for any country the does that, but mainly any country that is not the United States or China.

In the second piece of this series we talked about South Africa possibly becoming an ally with India and using that relationship to learn from and adopt a South African Stack of APIs that resemble India Stack. The benefits of which would be to digitise the entire economy and empower South Africa and its economy to be more efficient, and empower South African residents to build more digital applications which would make South Africa an authority and exporter of internet technology on a global scale.

In this piece, the third and final chapter of The Other Internet Country, we talk about adding crypto to South Africa Stack, and how this would benefit small businesses and the South African economy in general. Throughout this piece we’ll look at existing applications in India Stack and how crypto could play a role to improve the applications to create a more robust API stack.

But before we dive in, one thought we should keep in mind is the idea of currency influence, and how a country that is not the US or China can increase demand for its currency on a global scale. In that light we should ask ourselves why there is so much talk about digital currencies (digital yuan, digital rupee, etc). Remember that a digital currency in this sense means that the currency runs on smart contracts, which means it is bypassing a lot of the traditional financial rails and intermediaries such as commercial banks, SWIFT, and other institutions.

In that light, there are are two reasons for a digital currency. One is the national security it brings because the currency is hard to “cut off” from the rest of the world. The other reason is because digitising a currency makes it more accessible to the rest of the world, allowing the owner of the currency (native country) to attract pools of capital from around the world.

Adding a digital rand (digital ZAR) and cryptocurrency support to South Africa Stack (SA Stack), means South Africa would be running a permissioned public ledger which they could make use of for domestic transactions, while also using a permission-less decentralised ledger for international affairs . In this case South Africa is enjoying the benefits of national security by having a domestic currency that the South African Reserve Bank (SARB) fully controls, and is both easy to access globally and difficult to cut off from the rest of the world. Additionally, this would improve the open source SA Stack of APIs to the point where any country can use the stack for domestic and foreign transactions without having to depend on foreign corporations.

Lets review India Stack and the relevant crypto segment.

India Stack (“South Africa Stack”) review

India Stack is a set of national APIs that allow the entire country of India to run on open source digital software. The stack of technologies includes a digital identity layer, payments layer, and a data layer - each layer having different applications that run on those protocol layers. The layers work in an interoperable manner to allow for data security, and efficiency of transactions and information distribution throughout India. Because the APIs are open source, a number of great applications were able to be built for Indians.

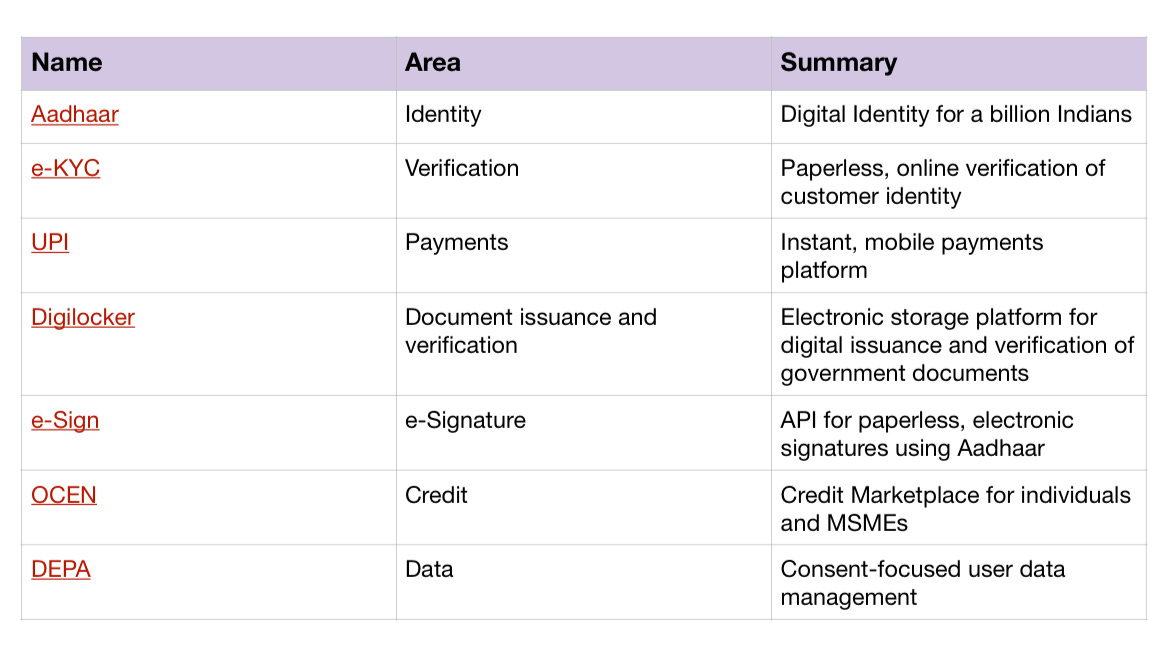

India Stack applications:

These systems are working and are highly preferred in India

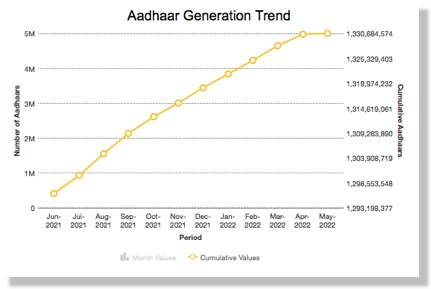

Almost the entire Indian population now has an Aadhaar identity

Put simply, if its working for a billion Indians it will work for 60 million South Africans.

In the case where crypto is added to these protocols, users would have access to the multi-billion dollar crypto-based financial services space.

DeFi review

Decentralised finance (DeFi) is a crypto ecosystem that provides financial instruments that are based on cryptocurrency and wider blockchain protocols.

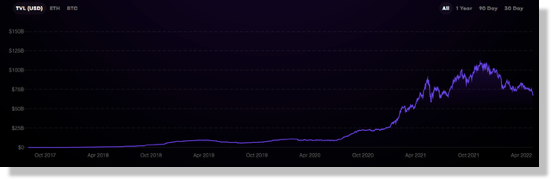

A lot of financial services that are available in the traditional world are being replaced by crypto based protocols thanks to Bitcoin, Ethereum and smart contracts. The DeFi space has close to $70 billion in total value lacked (TVL), and as seen on the graph above, the space is growing fast. The main reason for this growth is blockchain technology, and its main attributes - performance, programability and transparency.

Performance: Crypto payments can be broken down into micro payments where you can easily pay 1 000 different people R100 each in 50 different countries at once, while incurring very little or no cost in comparison to a similar transaction using traditional financial rails (commercial banks, SWIFT, etc). In some cases, because DeFi cuts out a lot of intermediaries and doesn’t really need real estate (physical office spaces), and cuts out a lot of in-office redundancies, you can find yourself earning higher returns from DeFi based lending products than you would if you invested the same amount of money in traditional financial instruments.

Here’s an illustration of how smart contracts have improved traditional finance

Programmability: The traditional finance world is made up of paper documents, Excel spreadsheets, and enforcement by the court of law. In the crypto world, smarts contracts allow you to write computer code that puts all of that together. Every few seconds the Ethereum blockchain is updated to accurately reflect updated or additional contracts and the movement of funds. Because Ethereum is a publicly distributed ledger and runs open source code, anyone can see, audit, and analyse all transactions that are run on the Ethereum blockchain - which is the blockchain on which most of the DeFi protocols are based. I’ve listed some examples of DeFi protocols which are improvements on traditional financial services:

Transparency: again this goes back to the point about publicly distributed blockchains. The availability of this public data makes it easier for developers to create more applications that incrementally service peoples’ needs. We mentioned in the previous article that data is like oil, and being data rich allows one (or a country) to leverage that data to create better products.

The DeFi space is growing extremely fast. To keep track I mostly look at coinmarketcap, defipulse, and try to follow relevant twitter accounts.

But the point is that crypto is to traditional financial markets what the internet was to general information. Easy to access, free, easy to track and trace information flows, and provides access to larger pools of capital. In most cases crypto can close funding gaps for startups and SMEs in South Africa.

In this next section I will borrow and summarise ideas from Balaji Srinivasen’s post where he suggested ways to add crypto to India Stack. What we’ll do for this section is pretend that SA Stack already exists and includes all of the products that India Stack actually has. My suggestion is that in the case where South Africa has its own API stack (SA Stack), and every South African has a smartphone - therefore access to SA Stack - it would make sense for South Africa to also include crypto elements in their stack.

Four steps to add crypto to South Africa Stack

Understand what a digital ZAR is

Add digital wallet support to SA Stack

Add crypto assets to the SA Stack digital wallet

Extend SA Stack APIs with crypto concepts

1. Understand what a digital ZAR is

When you open your Absa or FNB bank account app you see a digital balance of your funds. You can pay for things, and send money to your friends through the app. You can digitally transact in ZAR but this isn’t the same as a digital ZAR in the context we’re mentioning in this piece. Rather we’re talking about the ability to store, send and receive money outside of the banking system, just like how email gave you a way to send messages outside of the post office network. There are 4 stages to understanding a digital currency;

Stage 1: Physical currency. This is currency you can hold in your hands (bank notes, coins). You can withdraw it from the ATM, put it in your physical wallet, give it to someone, or feed it back into the ATM to update your balance. Physical currency allows download, storage, peer-to-peer transfer, and upload, outside of the banking system.

Stage 2: National quasi-digital currency. This is national currency whereby you can view a digital balance of funds on a screen, but can’t operate using that balance in the manner described in stage 1. This is quasi-digital because it doesn’t have the flexibility of a true digital currency. This is your funds available through your normal Absa or FNB banking app.

Stage 3: Quasi-national digital currency. This is a currency that is genuinely digital but is not actually directed or issued by a government (hence quasi-national). This is what stablecoins are. They are privately issued digital versions of currency where the coin is backed 1:1 with currency reserves held in a private company account. These are fully digital however, and you can log into your Coinbase account, send it to another account you hold (download, storage), then send it to your friend (peer-to-peer transfer). Every few seconds the blockchain is updated by miners and balances are updated.

Stage 4: National digital currency. This combines the legitimacy of a SARB issued ZAR with the flexibility of a stablecoin. This currency is more often referred to as a central bank digital currency (CBDC), so the adoption rate for this would be nation-wide, immediately. There are indeed problems with this type of reach where a central bank can intervene to freeze funds, etc but those can be worked out. The idea of a CBDC was never for state control, rather convenience for the economy.

2. Add digital wallet support to SA Stack

The payments layer and UPI would be the best insertion point. We saw earlier how UPI had become the payments mechanism of choice for most Indians. Digital wallet support would allow users to download and store currency, making use of private keys for security and also taking advantage of blockchain features to improve accounting and auditing.

A good example to look at is USDC, which is a stablecoin backed 1:1 by US dollars - where anyone can exchange USDC for dollars on any crypto exchange. When you open an account on the exchange you perform KYC, and account verification - already possible though Aadhaar and e-KYC so application integration is a feature in this scenario.

Adopting a digital currency would allow South Africa to take the next step - adding crypto assets to the API stack.

3. Add crypto assets to SA Stack digital wallet

In the first piece of this series I mentioned that crypto adoption leads to more crypto adoption. The reason is the exciting and beneficial features in the crypto space. Adopting a digital currency will lead users to want access to more crypto features - mainly because of the pools of capital and mechanisms for capital appreciation that exist in the crypto space. It would be best to integrate existing crypto financial products (see above) as well as South African specific crypto products that would likely more accurately service South African demographics. In this case you benefit from both international transactions and domestic product innovation that would likely attract large sums of foreign capital.

These crypto products could do a lot to benefit the South African venture capital space and the broader startup and SME space, because people can crowdfund a business or startup, network internationally on public platforms and attract capital, and also get easier access to micro-financing though the crypto space.

Your digital wallet can act as an asset management tool, and this wallet can be made available to every South African resident.

4. Extend SA Stack APIs with crypto concepts

Looking at the most common tools in the SA Stack, each can be improved with crypto integrations.

A Crypto South Africa Stack would also benefit South African small businesses, startups, and rural South Africans.

Here are 3 case studies outlining how that would work:

Case Study 1: SA SMEs use Crypto SA Stack to gain access to crypto based credit.

The World Bank estimates that SMEs represent 90% of businesses and more than 50% of employment worldwide. In South Africa SMEs represent more than 98% of businesses and employ 50 - 60% of the country’s workforce across all sectors. Although they lag other regions, South African SMEs contribute 39% of SA’s GDP, which is still quite significant.

Having access to crypto credit would encourage more entrepreneurship, maintain and drive performance and growth for South African SMEs, while helping to solve a lot of the employment issues facing South Africa. This could happen through the DeFi space which has grown 7x from May 2020 to May 2022.

Here are a few decentralised finance lending products that SMEs would have access to

Result:

Through Crypto SA Stack, it would be easier for South Africa to encourage foreign crypto investors to finance SA SMEs through these crypto based financial products

Case Study 2: South African startups use Crypto SA Stack to raise crypto crowdfunding.

In the last five years only $410 million has been invested in the SA venture capital space. South Africa has a long way to go to be able to compete on the global venture capital stage.

In 2021 India had the third most unicorn companies (companies valued at $1 billion+ before IPO or acquisition) after the US and China.

In 2021, India had the fourth largest venture capital market in the world, after the US, China, and the UK.

Between 2020 and 2021, India had the fourth largest amount of funds invested in venture capital

The top 4 countries represent a $390 billion venture capital market that South Africa would have access to through a Crypto SA Stack. As an example, Indian developers who built an Ethereum scaling service called Polygon were able to attract crypto capital from around the world, turning them into India’s first crypto protocol valued at $1 billion.

Why shouldn’t SA startups achieve such? Crypto SA Stack would make this possible by connecting SA startups to crowdfunding sources and human capital on a global scale.

Case Study 3: SA rural citizens use Crypto SA Stack’s digital wallet to access more financial services.

Millions of South Africans in rural areas have to travel to shopping centres or supermarkets to collect government benefits, then stand in long queues to mostly withdraw and hold cash. With Crypto SA Stack, this money can just be deposited into the citizens’ digital wallets. This would immediately give millions of less fortunate South Africans access to international markets, allowing citizens to broaden their horizons to give themselves a better chance at improving their economic situations. This would take a bit of the load off of the national government and also allow the government to collaborate with international markets to come up with more ideas on how to improve the economy. For a little more insight into why this makes sense, I’ll refer you to the first piece of this series.

We’ve just looked at 3 case studies outlining the benefits of a Crypto API stack. Its important to note that as we had mentioned in the first piece of this series, crypto is a form of high technology, and heavy investment into crypto at the national level would be a sign of competence in high technology for South Africa. This would attract international pools of capital, improve education domestically, and improve the broader domestic economy. This is also important as it would limit the amount of influence that larger nations such as the United States and China would have on South Africa.

Additionally, an alliance with India, THE internet country, would do a lot to drive global mindsets away from destruction and dominance at all costs, and more towards collaboration and the improvement of general society. Leveraging this stack of technology and the international collaboration that the stack would allow, South Africans (working closely with India) would come up with a host of innovative applications which service people globally. This would also make South Africa an exporter of internet technologies in a similar manner as India.