Shoprite is 11x Bigger than Pick n Pay! Here’s why Shoprite Will Keep Beating Pick n Pay

To Investors,

A few weeks ago the Ackerman family announced that they would give up their controlling stake in Pick n Pay, one of South Africa’s largest grocery retailers, in a strategic move to restructure the company and its goals.

Naturally, I was shocked, but intrigued at the same time so I pulled up their stock chart and put it up against Shoprite (the largest South African retail grocer by market cap).

The image was surprising for someone who’s never paid much attention to the grocery/retail industry. Since 2003 Shoprite’s stock price has gone up 3 000% vs Pick n Pay’s 90% appreciation and Spar’s 360% appreciation in the same period.

I did some more digging to understand why.

At first glance if you compare the South African grocery store market by number of stores (including all brands under a company group), Spar Group is the largest, followed by Shoprite Group, then Pick n Pay Group in third place.

However, when South Africans were asked: “from which of these stores do you regularly buy food and products for everyday use?” more shoppers preferred Shoprite and Checkers over Pick n Pay and Boxer. Also from a purely numbers perspective, Shoprite Group has more brands and therefore takes up more market share. A huge competitive advantage for Shoprite.

Looking at the three charts above, the reason for Shoprite’s stock outperforming Pick n Pay’s became clearer: Shoprite is the category winner. Investors love the category winner.

I think that Shoprite will continue to outperform Pick n Pay.

Here’s why, looking at three key categories: Operations, Capital, and “What’s Next.”

Operations

Shoprite has 25 brands under its umbrella, vs Pick n Pay's 4 brands.

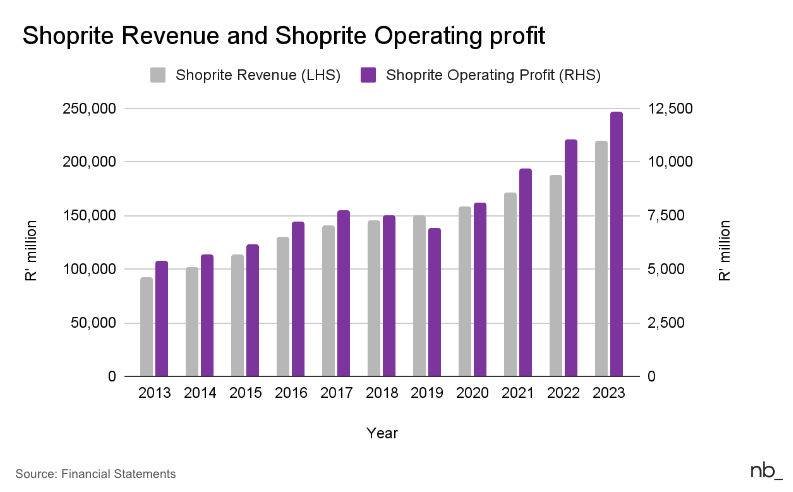

As a group, in 2023 Shoprite’s revenue was R219.5 billion - twice Pick n Pay’s revenue.

Shoprite is proving to be better allocators of capital, showing consistently higher operating profit margins vs Pick n Pay.

Here’s a look at Shoprite’s consistently higher free cash flow balance vs Pick n Pay…

… which they are allocating effectively to markedly increase revenue and reduce operating expenses at the same time.

And although Pick n Pay’s (- 4 days) cash conversion cycle is slightly better than Shoprite’s (10 days) …

… Shoprite still has more efficient operations than Pick n Pay. In 2023, for every R1 invested in capital expenditures, Shoprite generated R1.83 in operating profit, and Pick n Pay did half of that.

Capital Structure and Capex

Pick n Pay is heavily leveraged, with a debt-to-equity ratio of 98%, 108%, and 77% in 2021, 2022, and 2023, respectively.

In other words in 2022, for every R1 in equity, Pick n Pay had a little more than R2 in debt.

From 2013 to 2023 Pick n Pay had R31 billion in invested capital. Shoprite had R223 billion, which raises 3 questions:

What did Pick n Pay do with its debt?

Looking at the chart below it appears the extra debt may have been to cover losses in some stores which caused Pick n Pay’s 1% compound annual decline in operating profits.

How is Pick n Pay allocating its expenditures?

Investors will question capital expenditure if it doesn't have a positive impact on your operating metrics.

What could Pick n Pay have done differently with respect to capital structure and capex?

Instead of cutting their dividend while taking on debt to tackle loss making operations, Pick n Pay maintained its dividend. This comes across as a lack of positive risk taking. Investors may have been fine with a lower dividend as long as the future prospects of the company look exciting, with less debt.

These three points support the statement that Pick n Pay management are not great capital allocators.

One important note I’ve learned is that the stock price of a company today reflects what investors think about the future prospects of a company. In other words whatever management has penned as their strategic goals that they are striving for is already accounted for in the stock price today.

This next section will outline the future of Shoprite vs Pick n Pay and why Shoprite will continue to beat Pick n Pay.

What’s next?

In a predictable industry like grocery retail the standout performers nowadays are those that have an edge. Great examples are Amazon Go and Walmart Go - innovative cashier less stores; as well as the digital warehouses that Amazon and Walmart are making use of.

Conceptualised in 2019, ShopriteX has provided that edge for Shoprite as a group.

ShopriteX is Shoprite’s digital hub which focuses on integrating data science and technology to create personalised shopping experiences, optimise operations, and drive innovation.

While investing in digital initiatives, Pick n Pay lacks a comprehensive, integrated approach like ShopriteX.

To date the success of ShopriteX is proven by the fact that 1) Checkers Xstra Savings and Shoprite Xstra Savings are the most used loyalty programmes in South Africa; and 2) the Checkers Sixty60 app, is South Africa’s number one grocery retail app.

Coming soon will be Checkers Rush, a drive to introduce self-checkout stores under the Checkers brand, following the likes of Amazon and Walmart.

With Checkers Sixty60 and Checkers Rush, there’s an opportunity to introduce a mobile wallet similar to the Starbucks app or the Uber app.

These apps allow customers to pre-load cash on the app, which would unlock the following benefits for Shoprite:

Convenience: It allows for quicker and easier transactions at Checkers locations. Customers can simply scan their app to pay, avoiding the need to carry cash or cards.

Loyalty Rewards and Special Offers: Preloading money may tie into the Xstra Savings loyalty programme. Some savings opportunities may only be made available for customers using the app to pay. These customers may also have access to exclusive offers and promotions - especially considering that Shoprite owns Computicket which is one of the largest ticketing platforms in South Africa. This will drive more usage.

Budgeting: It helps customers manage their spending on groceries by preloading a specific amount of money which can act as a budget.

Security: It provides a secure payment method, reducing the risk of carrying cash or exposing card details during transactions.

Cost Savings: This will reduce the bank fees that Checkers pays to Visa and MasterCard when customers pay for groceries using their bank cards - further improving Shoprite’s operating profits.

A mobile wallet through Checkers Sixty60 will also unlock what’s referred to as Float for Shoprite.

Float is the money a company gets that is effectively an interest free loan. In insurance it’s the monthly premium that customers pay, in banking its customer deposits. In a mobile wallet it’s a similar concept because customers preload cash, which they might rarely withdraw if at all. That preloaded money can be used by a company for capital expenditure, at zero interest rates.

What’s Pick n Pay doing?

Pick n Pay is also investing in growing its online business though the Pick n Pay delivery app, as well as through partnerships with Takealot and Mr D for wider online shopper reach.

In a recent comment, Pick n Pay executives mentioned that they would like to focus on building out and potentially publicly listing Boxer Stores as its own entity.

There may be an opportunity there because Boxer has a higher consumer preference than Shoprite’s lower priced grocer offerings OK Foods and Usave (see earlier chart).

However, Pick n Pay has a mountain to climb because Boxer still has a lower consumer preference vs Shoprite stores and Boxer is half the size of Shoprite stores and Usave stores by revenue.

In closing, the market is not buying Pick n Pay’s ability to execute and continues to believe in Shoprite and ShopriteX. Looking at the chart below, since ShopriteX was introduced in 2020/21 (green block), Shoprite’s stock has gone up 53% (green arrow), while Pick n Pay is down 65% (blue arrow). For context on investors' view on the market, Spar is down 40% in the same period - further highlighting the premium investors have on Shoprite’s stock.

The continued competition between Shoprite and Pick n Pay will be interesting to watch. I’m excited to see how ShopriteX will further positively impact Shoprite. Without a similar focused approach on technology and innovation, Pick n Pay will continue losing to Shoprite.

I hope you enjoyed this letter.

One the journey to becoming a master capital allocator - one lesson down, a billion more to go.

Respectfully,

-Mansa

If you liked this post, feel free to hit the subscribe button and share with someone who might also find this interesting.

What did you think about this letter? Let me know in the comments 👇🏾

Disclaimer: this note is not financial advice and is for informational and entertainment purposes only. We may hold positions in the companies discussed. Do your own research.