My Brain Food This Week...

Trafigura thinks copper demand is about to skyrocket, the macro picture is not a good one for bitcoin, and I wrote about how best to save Eskom

Story of the week:

The SA Government Should Make Eskom Smaller

(Mansa Sithole)

Key takeaways:

Aggressive Action Needed: Despite government efforts to alleviate Eskom's debt, rolling blackouts persist in South Africa. A more aggressive approach to address the energy crisis is needed by shifting market share from Eskom to residential solar initiatives.

Phased Strategy: First, heavily subsidise residential solar installations to promote independence from the national grid and potentially turn households into net energy producers. Second, implement nationwide net metering systems, following successful examples like Cape Town, to stimulate economic activity and eventually facilitate a peer-to-peer energy sharing system.

Potential Impact: By reducing reliance on Eskom and promoting residential solar, the national grid's strain could be relieved, allowing Eskom to focus on restructuring.

What are your thoughts on this idea to change the way SA produces electricity?

Share your thoughts in the comments 👇🏾

🌐 Global

Trafigura predicts that technological advancements in electric vehicles, power infrastructure, AI, and automation will drive an additional 10 million metric tons of copper consumption over the next decade. Graeme Train, head of metals analysis at Trafigura, highlights that electric vehicles alone will contribute to one third of this demand, with the rest coming from sectors such as electricity generation, transmission, distribution, automation, manufacturing, and data centres. The surge in demand for copper, exacerbated by tight supplies and disruptions like the closure of mines, has led to record-high prices nearing $10,000 a ton on the London Metal Exchange. Analysts anticipate significant shortages in the copper market, estimated at around 26 million tons this year, as demand continues to rise, especially in emerging economies like India where per capita consumption remains relatively low compared to China and developed countries.

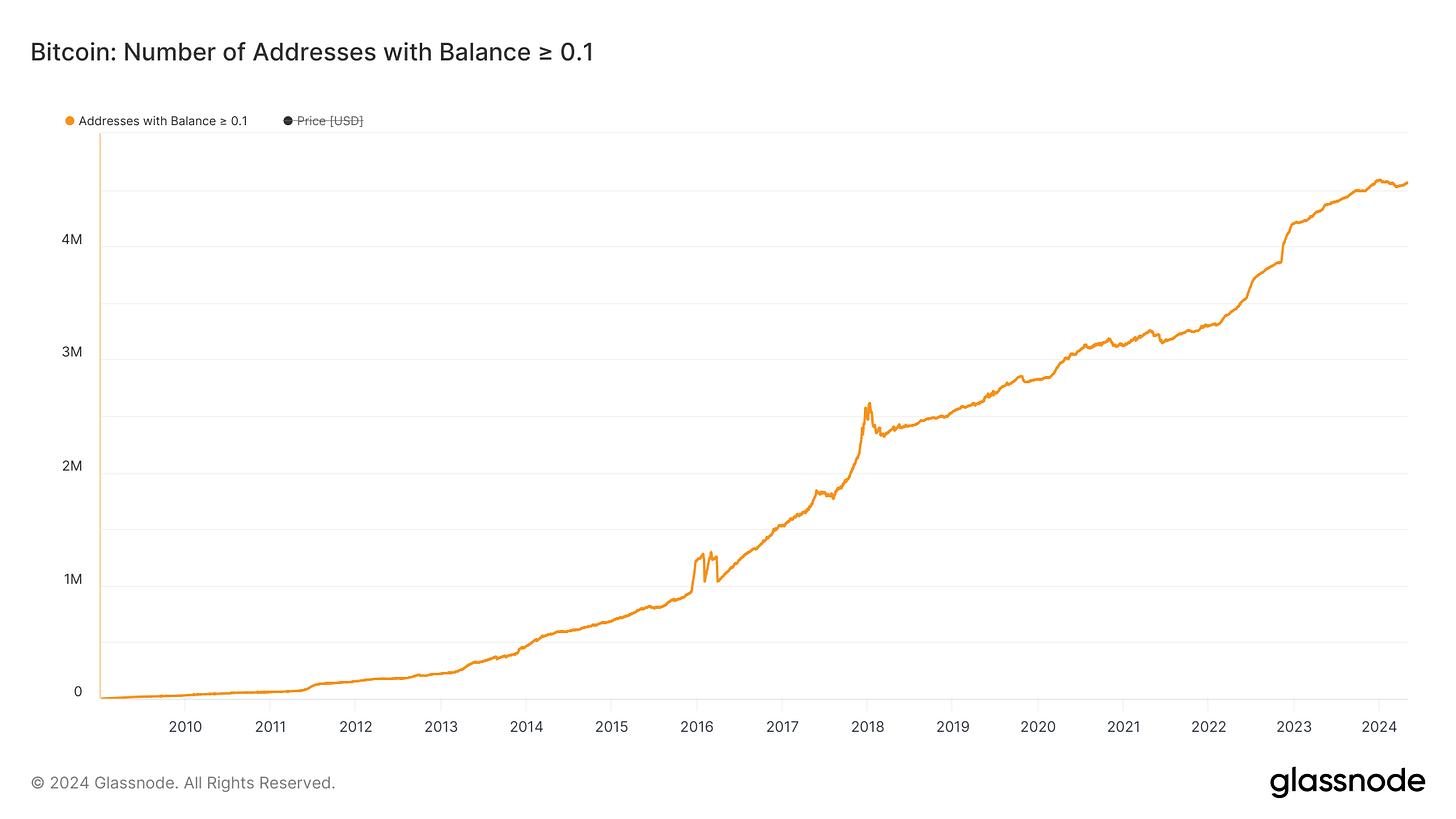

Despite expectations of a significant surge following Bitcoin's halving, recent weeks have seen its price falling, prompting questions about the cause. Historical data suggests that while the month after the halving typically sees modest gains, the year following tends to bring substantial increases. Current market downturns may be attributed to broader macroeconomic factors rather than intrinsic issues with Bitcoin, with analysts pointing to concerns over global economic growth and central bank actions. Despite price fluctuations, Bitcoin's network metrics remain strong, indicating continued adoption and usage. Investors are reminded to maintain perspective amidst market volatility, with reassurance that Bitcoin's long-term investment thesis remains unchanged despite short-term turbulence

Other reading:

🚀 Podcasts and Video

🤔 What did you think of the story of the week, or any other piece of content?

Let me know in the comments 👇🏾

P.S we’re growing this into THE BEST platform to empower you to become a master capital allocator. We’ll need your valuable insights into how best to improve. Please complete this very short survey: Link