My Brain Food This Week...

The silent infrastructure behemoth now working with BlackRock, MANG is the new VC in town, markets update

Story of the week:

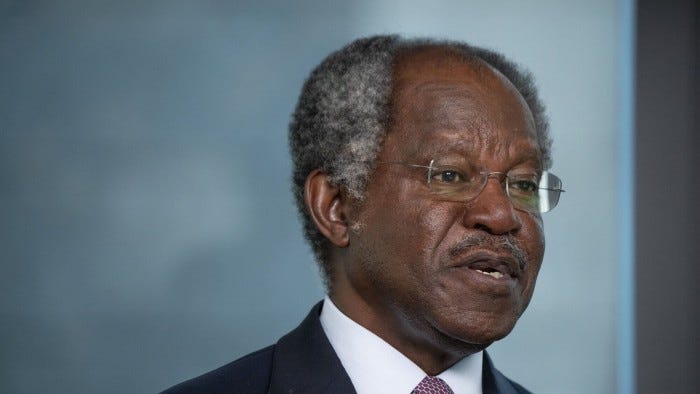

How Adebayo Ogunlesi’s contrarian bet led to $12.5bn BlackRock tie-up

(Antoine Gara and Brooke Masters)

Key takeaways:

Career Transformation and Success: Adebayo Ogunlesi, co-founder of Global Infrastructure Partners (GIP), made a significant career switch from banking to investing at the age of 52, driven by an ultimatum from his wife. Over 17 years, GIP, under Ogunlesi's leadership, quietly amassed $105 billion in assets and pioneered a $1 trillion sector focused on infrastructure. The recent $12.5 billion deal with BlackRock cements Ogunlesi's position as one of Wall Street's wealthiest and most powerful figures.

Strategic Investment Approach: Ogunlesi and GIP chose to focus on infrastructure as an investment niche, identifying it as an area with little competition. The success of GIP was not without challenges, including a disastrous investment in a UK waste management company in 2008. Ogunlesi's emphasis on hiring smart individuals, implementing operational improvements, and a focus on customer service contributed to GIP's success in managing a diverse portfolio, including airports, energy plants, pipelines, and data centres.

Transformational BlackRock Deal: The recent deal with BlackRock is described as "transformational" by BlackRock CEO Larry Fink. The $12.5 billion deal, with Ogunlesi becoming a board member and part of BlackRock's global executive committee, aims to leverage BlackRock's $10 trillion asset management influence to further expand infrastructure investments. Ogunlesi sees the opportunity to build the premier infrastructure investing business within BlackRock and emphasises that the move is not about cashing out but about the growth potential in this strategic partnership.

💎 Africa

A visual summary of 2023 Africa venture capital funding trends

South Africa’s Gas to Power Independent Power Producer bid window is open

🌏 Global

Global renewable energy capacity grew by 50% in 2023. China produced more solar power in 2023 than the entire world did in 2022

Markets are already pretty sure about what the Federal Reserve is going to do. Anthony Pompliano rates: “The Central Banks Work For Us Now”

Global liquidity is on the rise. Asset prices may be about to go higher

Microsoft, Amazon, NVIDIA, and Google are being clever about their corporate venture capital approach