My Brain Food This Week...

Disruption in the Red Sea might shake up global trade, and a number of Bitcoin spot ETFs are finally approved.

Story of the week:

What Will a Bitcoin ETF Mean for Bitcoin? Lessons From ETF History

(Guest post by Matt Hougan)

Key takeaways:

Historical Precedent with Gold ETFs: The launch of the first U.S. gold ETF in 2004 led to a nine-year consecutive rise in the price of gold, fundamentally transforming it as an investment. The ETF attracted significant inflows, altering the demand balance for gold and contributing to its prolonged positive performance. While Bitcoin is not the same as gold and circumstances differ, the historic impact of ETFs on alternative assets provides an interesting lesson for the potential influence on Bitcoin.

Gradual Buildup of Investor Flows: Similar to the experience with gold ETFs, inflows into Bitcoin ETFs are unlikely to occur all at once. The example of gold ETFs shows a gradual increase in inflows over the first nine years, indicating that investor interest builds up over time. The slow adoption can be attributed to the need for platforms to approve ETFs, and as investors become more comfortable with the asset, flows start to accumulate.

ETF's Effect on Accessing Bitcoin: Contrary to concerns about cannibalisation, the launch of gold ETFs did not replace other ways of accessing gold, such as buying physical gold or investing in gold miners. Instead, the ETF helped establish gold as a mainstream investment, attracting a broader investor base. The same may happen with Bitcoin, where new demand through Bitcoin ETFs does not cannibalise existing methods of accessing the cryptocurrency, such as platforms like Coinbase.

🌏 Global

The U.S. securities regulator on Wednesday approved the first U.S.-listed exchange traded funds (ETFs) to track bitcoin, in a watershed for the world's largest cryptocurrency and the broader crypto industry.

DOJ close to filing massive antitrust suit against Apple over iPhone dominance: report

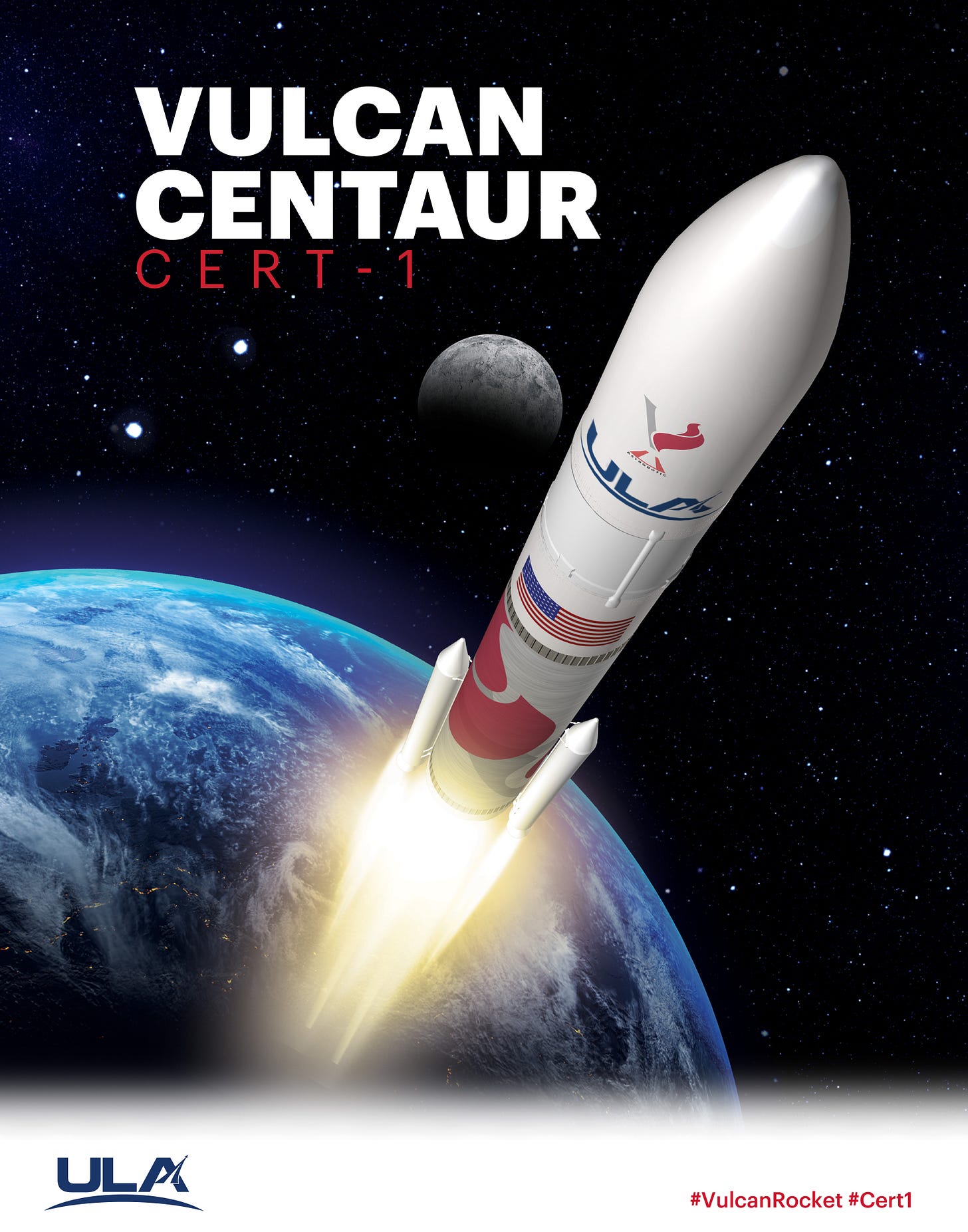

United Launch Alliance makes an attempt to accomplish the first moon landing by a private company. The Cert-1 flight was carrying the Peregrine Lunar Lander, which if all goes well, will touch down on the surface of the moon sometime in February 2024.

Freight prices are set to jump Monday, while longer transit times around Africa are disrupting and delaying deliveries of products.

US launches new strikes on Yemen’s Houthis as conflict escalates