My Brain Food This Week...

Another oil company leaving South Africa, the best business podcast in the game rakes in millions for its hosts, and I outlined a framework to help you decide if your company is ready to go public

Story of the week:

Is Your Company Ready to Go Public?

(Mansa Sithole)

Key takeaways:

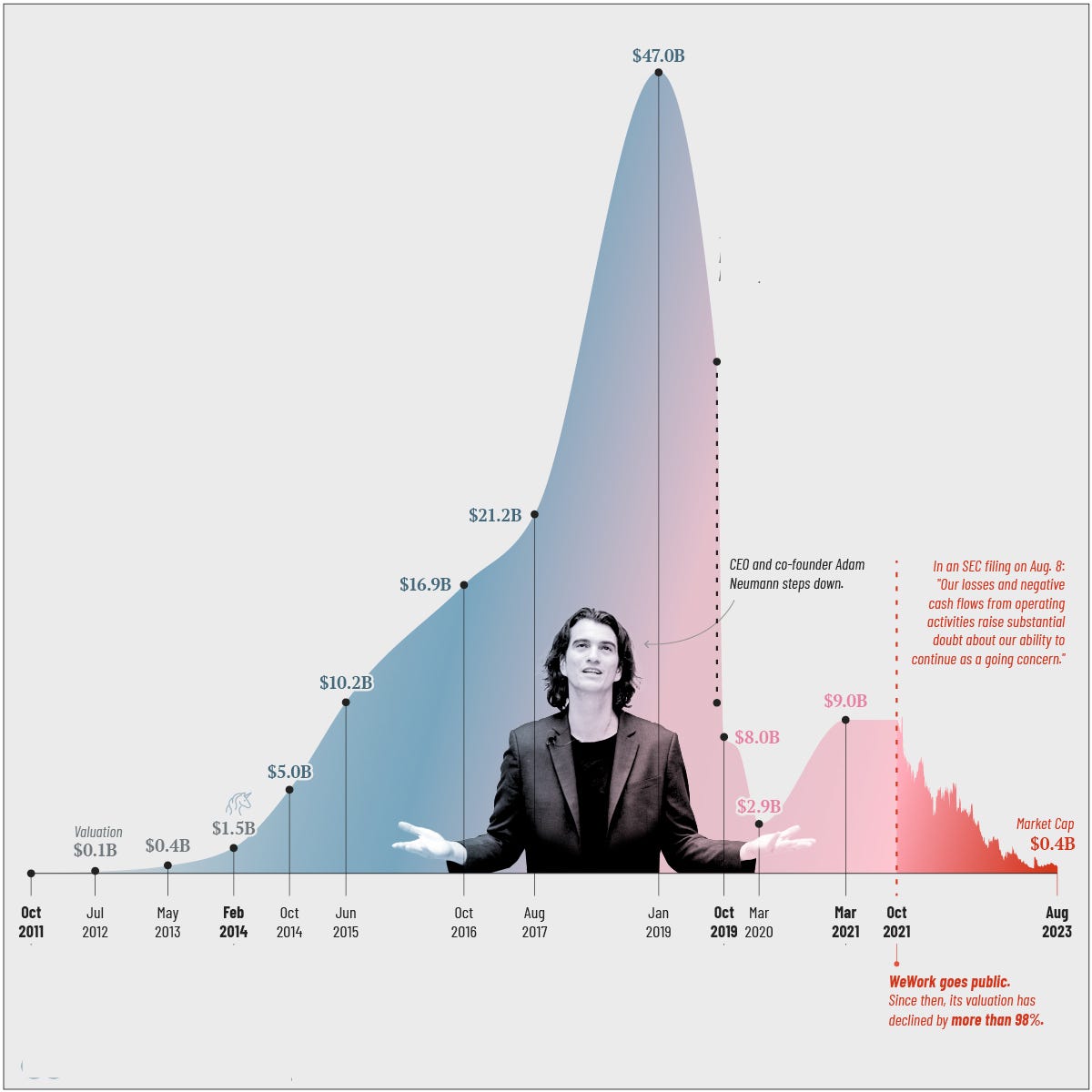

Profitability Isn't Everything: Contrary to popular belief, profitability isn't a strict prerequisite for a successful IPO. Amazon and Tesla went public while still unprofitable and saw tremendous share price growth afterward.

Corporate Rigor and Exposure: Going public subjects a company to rigorous quarterly reporting and scrutiny from global investors. This level of exposure demands accuracy, transparency, and a commitment to corporate governance.

Striving for Market Leadership: Public markets favour companies that aim to be the best in their sector. Being a market leader is crucial for sustained success post-IPO. Look at Uber vs Lyft.

Proving Long-Term Viability: The decision to go public hinges on demonstrating a clear roadmap for achieving significant goals and sustaining market leadership over time. Confidence in execution, sustained excellence, and a long-term vision are essential for success in the competitive landscape of public markets.

What are some positives/negatives you’ve noticed about publicly listed companies vs private companies?

Share your thoughts in the comments 👇🏾

💎 Africa

The Fuel Retailers Association of South Africa (FRA) has expressed concern over the alarming rate at which oil companies are leaving the country, with Shell following Chevron and Engen. Shell's decision to divest its shareholding in Shell Downstream South Africa after 120 years is part of its global strategy to reshape its downstream portfolio. FRA CEO Reggie Sibiya attributes these exits to regulatory failures impacting margins and businesses. Despite the departures, Sibiya believes the Shell brand will protect its retailers from losing customers, hoping for an improved relationship with a potential buyer.

🌐 Global

Acquired, a podcast renowned for its deep dives into business history and strategy with monthly four-hour episodes, has garnered a fervent following from Silicon Valley to Wall Street. Hosts Ben Gilbert and David Rosenthal delve into the successes of corporate giants like Pixar, Tesla, and LVMH, dedicating meticulous research and storytelling finesse to each episode. Transitioning from solely tech acquisitions to broader company narratives, they've attracted top executives and even created investment opportunities. Their rigorous approach involves exhaustive research, rigorous editing, and an ethos of respecting their audience's intelligence. With plans to cover iconic companies like Apple, Google, and Disney, Acquired aims to craft timeless narratives that captivate listeners for years to come.

On X…

Other reading…

🚀 Podcasts & Video

🤔 What did you think of the story of the week, or any other piece of content?

Let me know in the comments 👇🏾

P.S we’re growing this into THE BEST platform to empower you to become a master capital allocator. We’ll need your valuable insights into how best to improve. Please complete this 90 second survey: Tap to see