My Brain Food This Week...

Adam Neumann wants to buy back WeWork, Amazon is betting big on AI with Anthropic, and the digital asset company that's a sleeping giant

Story of the week:

The Stock I Would Have Pitched At The Sohn Conference

(Anthony Pompliano)

Key takeaways:

DeFi Technologies presents an undervalued investment opportunity: With its subsidiary Valour Asset Management focusing on creating Exchange Traded Products for non-US markets, particularly in the cryptocurrency sector, DeFi Technologies offers exposure to high-potential assets with substantial fee generation potential.

Rapid revenue growth: DeFi Technologies has witnessed exponential growth in Assets Under Management, increasing by over 800% from December 2022 to the present. This growth trajectory, coupled with a forecasted annualised revenue run rate of $46.8 million for 2024, suggests significant revenue acceleration without extensive sales and marketing expenses.

Potential for substantial upside: Considering the current market cap of approximately $140 million USD and the projected revenue for 2024, DeFi Technologies appears undervalued, particularly if the crypto market continues its bullish trend. The company's position in a rapidly expanding sector and its product offerings indicate strong potential for future growth and market outperformance.

Are you bullish or bearish about the digital asset space?

Let me know in the comments 👇🏾

🌏 Global

With bitcoin attracting attention now from the “big money” players, there now appears to be no more arguments against allocating a portion of your portfolio to bitcoin. Investors can get in and get out of bitcoin as an asset as they please, the crypto market is a trillion dollar market you can’t ignore, investor returns remain robust on the bitcoin ecosystem via the block subsidy and transaction fees, and the transparency of a public ledger makes bitcoin safer than the US dollar and traditional asset classes.

Amazon and Anthropic are collaborating to bring advanced generative AI technologies to customers worldwide. Anthropic is utilising Amazon Web Services as its primary cloud provider for safety research and future model development. Anthropic's Claude 3 family of models, now available on Amazon Bedrock, demonstrates near-human levels of intelligence and outperforms other models in reasoning, math, and coding. Various organisations across industries are already using Amazon Bedrock and Anthropic's AI models, with a recent announcement of a collaboration between AWS, Anthropic, and Accenture to help organisations adopt and scale generative AI solutions responsibly.

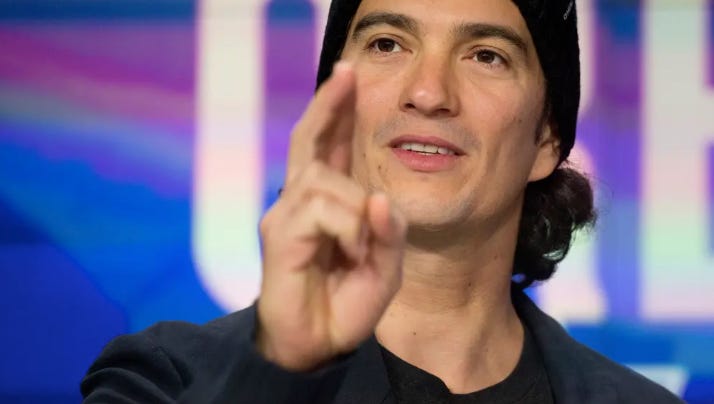

Adam Neumann wants to buy back WeWork for around $500 million after the company filed for bankruptcy. Following examples from the likes of Ryan Petersen and David Portnoy, Neumann wouldn’t be the first founder CEO to leave a company and then strive for a second coming.

Other reading…

Dutch hyperloop center aims to advance futuristic transport technology

California introduces 'right to disconnect' bill that would allow employees to possibly relax

🚀 Podcasts & Video

🤔 What did you think of the story of the week, or any other piece of content?

Let me know in the comments 👇🏾