To Investors

This past Friday and Monday we saw a lot of interesting movements in financial markets.

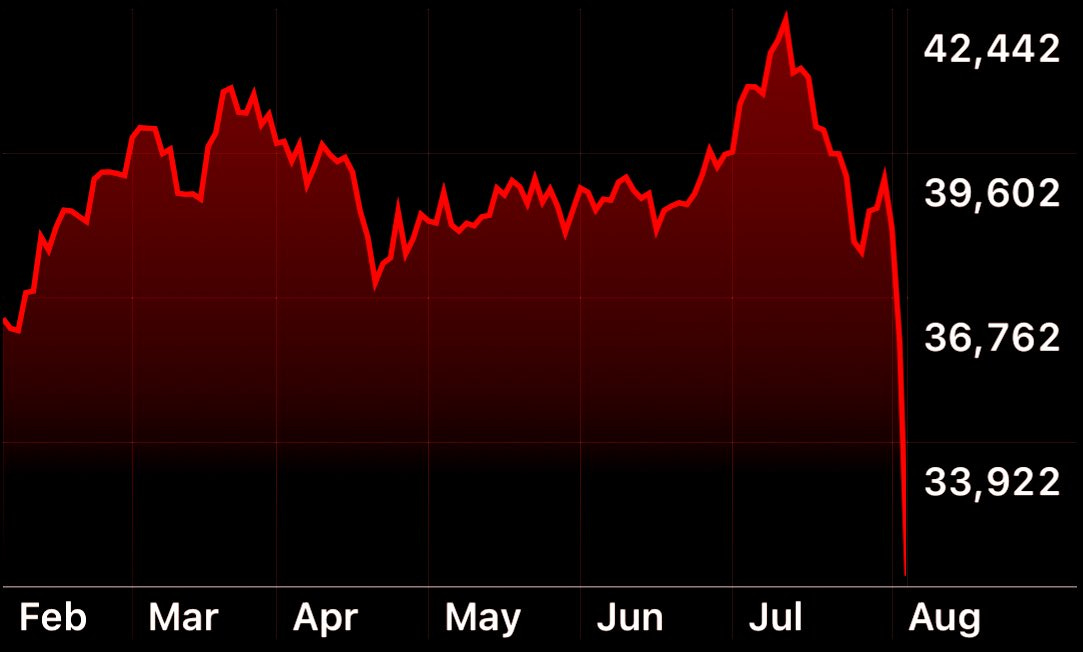

Most notably the Nikkei dropped 12% on Monday, its largest single day drop since 1987.

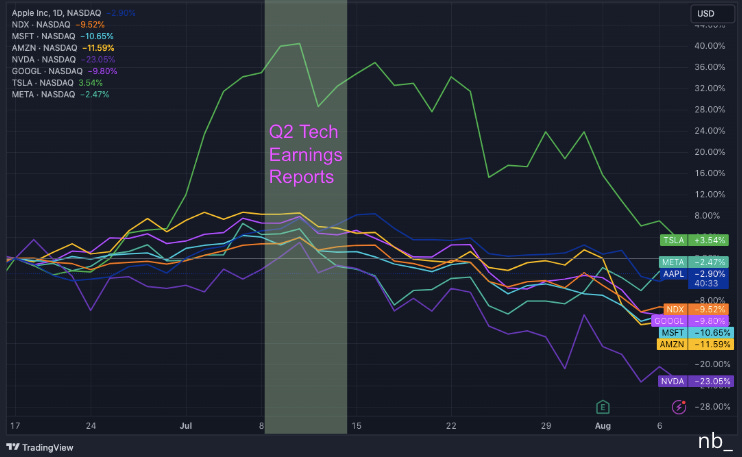

In the same period we saw a sharp decline in the Nasdaq 100 from 18453 to 17575, and most notably the magnificent 7 stocks all saw sharp drawdowns in trading (see chart below)

Here’s what I think happened…

Pandemic Buying

After the Federal Reserve Bank rapidly lowered interest rates from 1.75% in February 2020 to 0.25% by March 2020 to combat market fears from the Covid 19 pandemic, the U.S government stepped in to support the U.S economy with government spending through various policies from stimulus cheques for U.S citizens to the Inflation Reduction Act. These actions fuelled confidence in the U.S and in financial markets so people went out and spent money on stocks.

Yen Carry Trade

At the same time, Japanese investors borrowed Yen at -0.1% interest rates and sought to buy higher yielding assets such as Nasdaq listed stocks to take part in the stock boom taking place in the U.S.

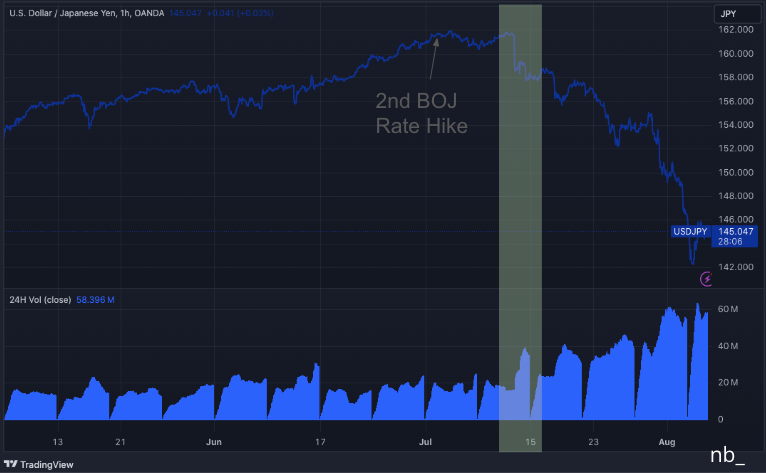

In March this year however, the Bank of Japan (BOJ) raised interest rates for the first time since 2006, from -0.1% to 0.1%, then they raised them again in July to 0.25%. That, coupled with the BOJ’s announcement that they would reduce their JPY bond buying program from a range of JPY 400-550 billion down to JPY 400 billion, meant interest payments for Yen carry trade investors were about to be higher so they trimmed their positions and took profits on their risky technology assets. In the chart below we see that this has been happening since the end of July this year, noting increased trading volumes pointing to demand for Yen as traders converted profits from dollars to yen.

The Magnificent Seven

Over the past year the S&P 500 has outperformed the S&P equal weighted index, due to seven companies who made up 35% of the S&P according to Fortune.

The reason for the outperformance of these magnificent seven companies (Tesla, Meta, Microsoft, Nvidia, Amazon, Apple, Alphabet) is that they are believed to be the best way to get exposure to artificial intelligence, the most recent innovation hype globally. Nvidia provides the A.I infrastructure, and the six other companies have been investing billions of dollars on internal A.I projects.

The problem with A.I currently is that for every new A.I model that comes out, a better one is released a few months later. Case in point is how ChatGPT 4o was first released in May 2024 and in July Meta released Llama 3.1, which reportedly outperforms 4o in a number of examples which you can read here.

In that light, the magnificent seven stocks have been taking a beating since mixed earnings results have started to be released so far for Q2 2024.

One important question investors may be asking is: where will the return on investment come from on the billions spent on A.I?

US Economy

U.S GDP has been trending lower on a per quarter basis, going from 4.9% in Q3 2023 to 1.4% in Q1 2024.

The unemployment rate in the U.S has been rising from 3.8% in March 2024 and reached 4.3% in July of this year.

The indication appears to be that the US economy is slowing down, also considering the fact that non farm payrolls are trending lower, showing 216 000 jobs added in May 2024, down to 144 000 in July 2024 (well below the forecasted 175k jobs for July this year).

The Result

Investors are a little worried that there’s been a bubble in U.S tech stocks, especially the magnificent 7, and that it may be time to trim the exposure and take profits, noting signs of a weaker U.S economy as well - which brings us back to the points at the beginning of the letter about the Nikkei and the Yen carry trade.

How Does This Affect South Africa?

The United States is the most influential economy in the world. When there’s a recession in the US, it eventually spreads to the rest of the world, and the same happens when times are good in the U.S. We most recently saw this in 2007 when a housing market bubble bust in the U.S spread into a global financial recession. The reason the U.S is the most influential economy is because the U.S is a super power like no other country in the sense that the U.S is the second largest exporter in the world and therefore is a major trading partner for most of the world, the U.S dollar is the world reserve currency and trade currency, and the U.S is the largest bond issuer in the world - with a $51 trillion bond market in 2022 according to the World Economic Forum, which was 38% of the global bond market.

One way or another the entire world has exposure to the United States and U.S assets. Should the US. economy continue to cool down, and perhaps even enter a recession, emerging market countries such as South Africa can be affected in the following ways at a very high level:

Reduced Trade: I had mentioned that the U.S. is a major trading partner for all countries globally. For South Africa (SA), 8.1% of all exports went to the U.S in 2023. A recession in the U.S. can lead to reduced demand for exports from South Africa, which would negatively impact SA’s trade balance and overall economic growth.

Commodity Prices: according to OEC data, 70% of South Africa’s $147 billion in exports were commodity exports. A U.S recession often leads to a decline in global commodity prices due to reduced demand, negatively affecting the revenues and economic stability of commodity-exporting countries like SA.

Investment Flows: during a U.S. recession, investors often seek safer assets, leading to capital outflows from emerging markets and into more stable economies or assets like U.S. treasury bonds. This can depreciate the rand as traders sell, which would lead to increased borrowing costs as investors would want a higher interest rate to be compensated for the higher risk.

Currency Depreciation: all else equal, currency depreciation can either result in higher import costs and inflation because you would need to supply more rands for every dollar, and/or result in increased export activity for South Africa because ZAR denominated goods would be cheaper for foreign buyers.

Interest Rates: if the U.S. economy is headed towards a recession, the Federal Reserve may lower interest rates to stimulate the economy. Lower interest rates in an economy can slightly weaken the country’s currency which can lead to higher exports, all else equal. Other countries may also reduce their interest rates to avoid a negative effect on their exports, however for SA the South African Reserve Bank would need to consider the fact that they have been struggling to keep inflation around the 4.5% target using interest rate policy as their main tool for fighting inflation.

Financial markets are tricky, but extremely interesting. It will be exciting to see how this next quarter plays out as we keep our eyes on the world’s central banks, especially the Bank of Japan, Federal Reserve, and South African Reserve Bank - and their effect on markets.

I hope you enjoyed reading this letter.

On the journey to becoming a master capital allocator, one lesson down, a billion more to go.

Respectfully,

-Mansa