To Investors,

A while ago I searched for the highest performing South African asset management company, and Fairtree Group popped up as having multiple funds that consistently beat their respective benchmarks.

Here are 4 of Fairtree’s most popular funds and a quick summary of some interesting notes I made for each.

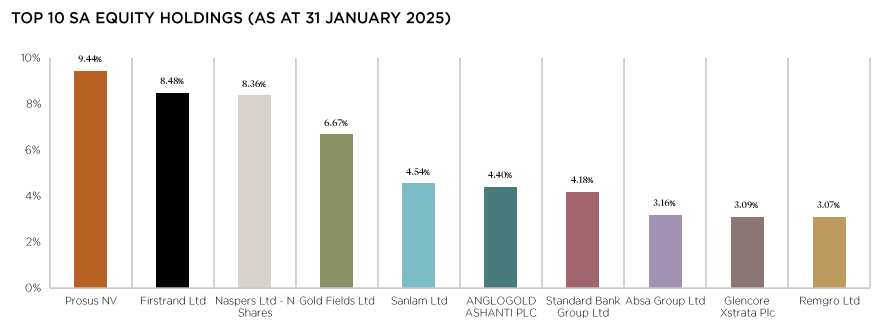

Fairtree SA Equity Prescient Fund

A R30.1 billion fund which focuses on South African equities. This fund is rated “Aggressive”, classically indexed to the South African economy. In South Africa the largest economic sectors are Financial Services and Real Estate, then the Resources economy. SA Equity Prescient has a 33% allocation to Financial Services, and a 24% allocation to Basic Materials. Sprinkle in Prosus as a high growth name, and you get a fund that since inception in 2011 has outperformed its benchmark FTSE/JSE Capped SWIX All Share Total Return by +4 points.

Sharpe Ratio: 0.51

Measures the additional return you get on an investment for the risk you take. The Sharpe ratio compares the returns on an investment to a “risk-free” asset such as government bonds, then considers positive and negative volatility. So, the higher the Sharpe ratio, the more reward you’re getting for each unit of risk you take.

Sortino Ratio: 0.93

Similar to the Sharpe ratio, however, the Sortino ratio only focuses on negative volatility. Sortino only considers the amount of times your investment goes below a certain target, ignoring upside swings. A higher Sortino means you’re being rewarded more for the risk of losses.

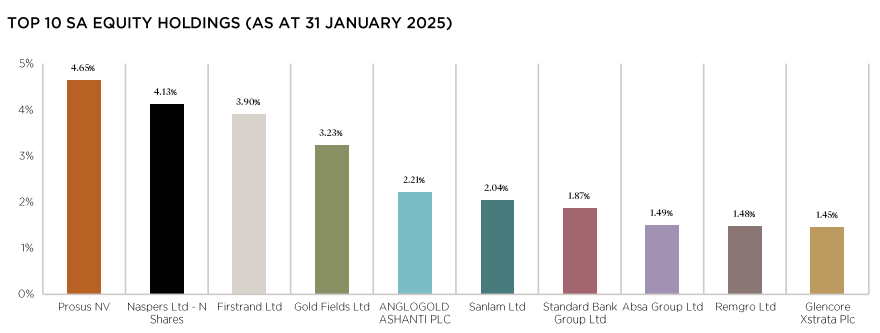

Fairtree Balanced Prescient Fund

This fund is rated “Moderately Aggressive”. At R4.1 billion, the Balanced Prescient Fund is also heavily concentrated at 34% to the Financial Services sector, however it has a slightly higher allocation to Technology at 18%, and 14% towards Basic Materials.

Since inception in 2017, this fund has outperformed the benchmark South African Multi Asset High Equity Category Average by +3 points.

Why is it moderately aggressive?

Because it has a slightly lower Sharpe Ratio (0.42) and Sortino Ratio (0.77) than the SA Equity Prescient Fund above, meaning you’re getting slightly lower rewards for your risk. Perfect for those who are slightly risk averse.

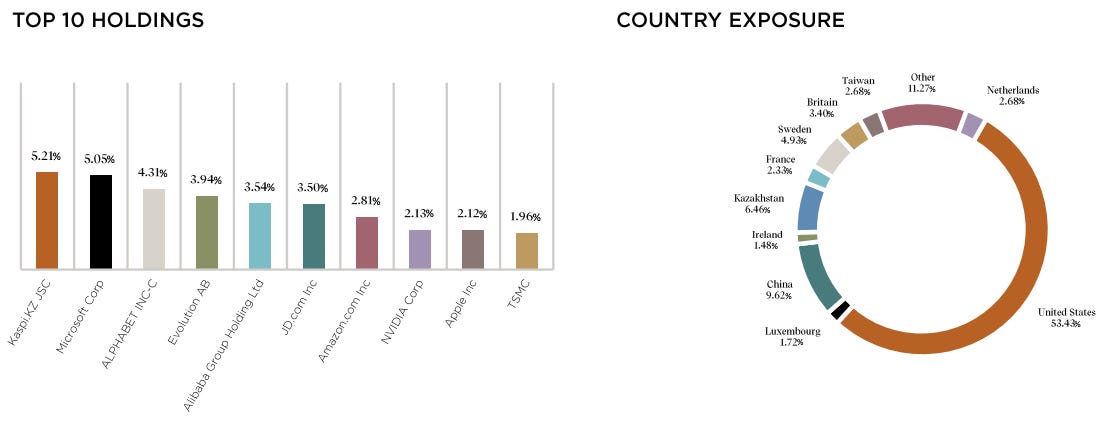

Fairtree Global Equity Prescient Feeder Fund

Rated as “Aggressive”, this fund is heavily geared towards United States equities at 54% – and concentrated at 35% towards U.S. technology companies. At R1.6 billion the fund also allocates to Consumer Discretionary holdings at 23%, adding more volatility because the “consumer discretionary” label refers to companies that sell products that people don’t need, but are nice to have, such as cars, household durables, certain e-commerce retail purchases, high-end apparel, and spending on travel and hospitality.

To balance that risk, the fund allocates to blue chip companies, meaning that even though those companies sell products that may be nice-to-haves, during a financial pinch consumers may choose to cut back on those expenditures only as a last resort, and financial markets and other funds are unlikely to sell those holdings because the names are “safe” – for example Microsoft, Alphabet, Alibaba, Amazon, Nvidia, Apple, TSMC, to name a few popular examples.

Since inception in 2017 this fund has lagged behind the benchmark S&P Global 1200 Total Return (ZAR) by a little over -1 point, but outperformed a secondary benchmark, Asia Global EQ General, by +3 points.

Sharpe Ratio: 0.57

Sortino Ratio: 1.12

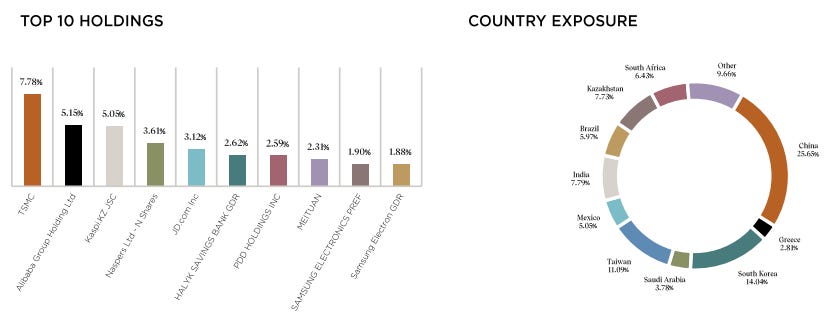

Fairtree Global Emerging Markets Prescient Fund

Labelled as "Aggressive". This fund focuses on global emerging market equities. The most obvious country to weigh heavily towards is therefore China. This fund, at R755 million has a 25% exposure to China, with a 39% exposure towards Financials, and 25% exposure to Technology.

Since inception in 2020 this fund has outperformed the benchmark MSCI Emerging Markets Index TR (ZAR) by a little over +2 points.

Sharpe Ratio: 0.25

Sortino Ratio: 0.46

Fairtree Group has a number of local and offshore funds, including Real Estate, Private Equity, Hedge Fund, and Infrastructure Debt Fund assets.

What’s one thing they are missing? … A dedicated digital asset fund for exposure to bitcoin.

I’m bringing this up because retail investors generally think about how high an asset can go, but more sophisticated investors (like fund managers) think about how much return they are getting for every unit of risk they take.

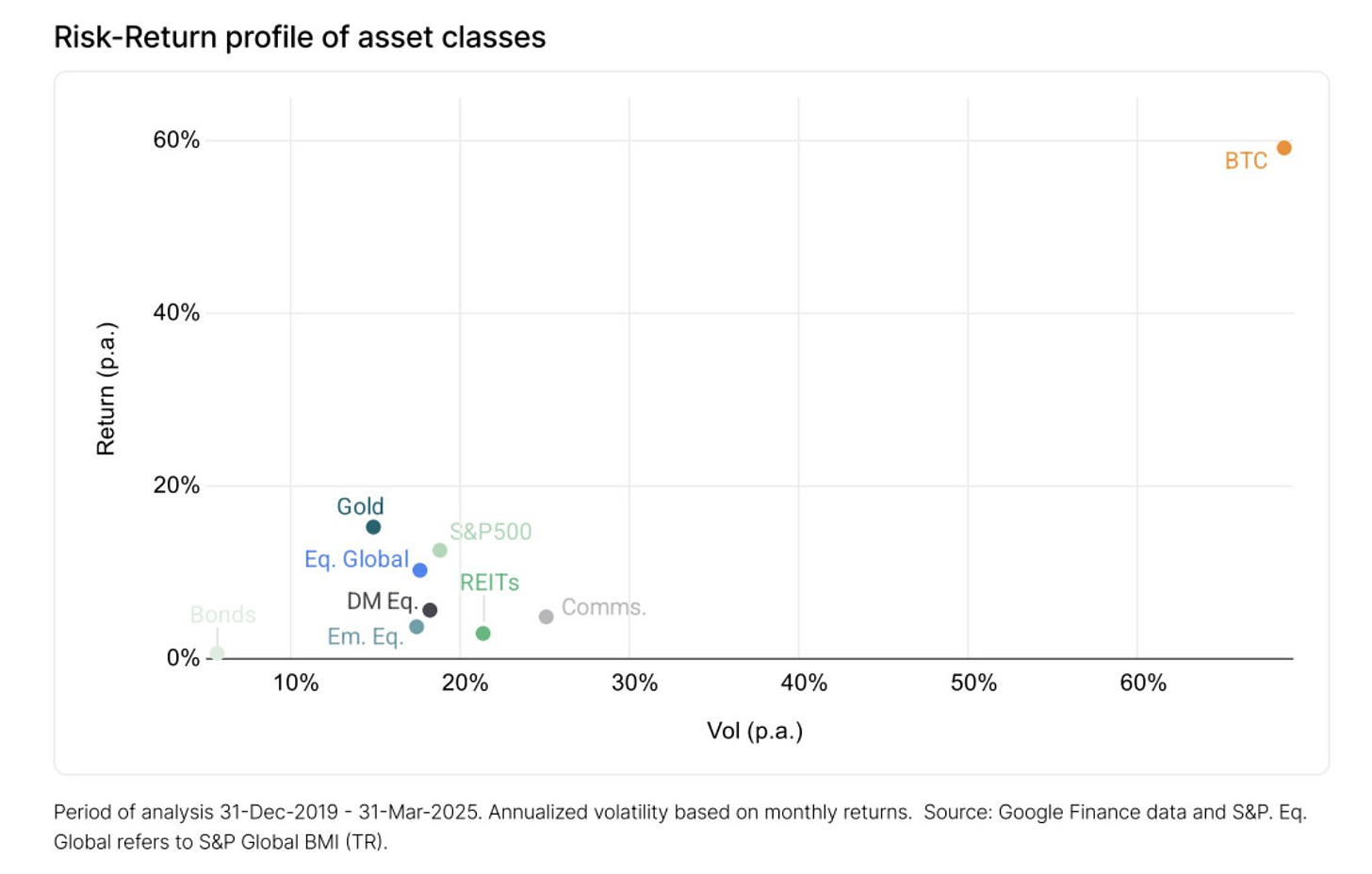

Look at this chart from Matt Hougan, showing that the risk-return profile for bitcoin decimates that of gold, the S&P 500, and any other asset class included below.

I’ve noted the Sharpe ratios for the four Fairtree funds above, but bitcoin’s Sharpe ratio blows all of those off the map. According to Case Bitcoin, bitcoin’s 5-year Sharpe ratio is 1.34. Compare this to the Fairtree SA Equity Prescient Fund (0.51), the Fairtree Balanced Prescient Fund (0.42), the Fairtree Global Equity Prescient Feeder Fund (0.57), and the Fairtree Global Emerging Markets Prescient Fund (0.25). All due respect to Fairtree, but those performances don’t hold a candle to bitcoin.

That said, Fairtree isn’t oblivious to the activity in the digital assets space. The firm bought a minority equity stake in MidSquare, a cryptocurrency and decentralised finance asset management business.

We’re starting to see more institutional capital flowing into the bitcoin and digital assets space as evidenced by the billions of dollars flowing into bitcoin ETFs, the political and regulatory support in the U.S. around the GENIUS Act, as well as the United States government (among other sovereigns) deciding to create a bitcoin strategic reserve.

It will be interesting to see how Fairtree grows its exposure towards bitcoin and the broader digital asset market.

On my journey to becoming a master capital allocator, one lesson down, a billion more to go.

Hope you all have a great day.

-Mansa