To Investors,

Last month it was reported that Nigeria renewed a currency swap deal to enable cheaper access to the yuan for trading purposes.

A currency swap is a financial agreement between two countries where they exchange their own currencies with each other for a set period. This allows each country to use the other's currency to pay for trade or settle financial obligations without relying on a third currency, like the U.S. dollar. In this example, Nigeria and China can swap naira for yuan and vice versa, helping them trade directly without needing to convert to dollars first.

This is a great example of strong trade ties between Nigeria and China and while this agreement will help Nigeria depend less on U.S. dollars, I think Nigeria should rather adopt a national bitcoin strategy to become self-sufficient, rather than swapping one economic crutch (the U.S. dollar) for another (the Chinese yuan).

Most recently, the naira has significantly depreciated against the U.S. dollar.

And because 19% of Nigeria’s imports were from China in 2023 - a currency swap with the yuan seems like a good idea for the short term.

The problem is that the Chinese yuan is widely regarded as one of the most managed currencies in the world. Its value is tightly controlled by the Chinese government, raising questions about the accuracy of its true market price. This lack of transparency in price discovery makes it difficult to trust the yuan as a stable or fair alternative to the U.S. dollar.

Additionally, unlike in many other countries, China’s national financial accounts and fiscal data are not open to public scrutiny or debate. This opacity further complicates efforts to assess the risks and implications of deepening financial ties through mechanisms like currency swaps.

Instead Nigeria should adopt a bitcoin standard similar to El Salvador.

El Salvador made headlines as the first country to adopt Bitcoin as legal tender. By integrating Bitcoin into its financial ecosystem, El Salvador has reduced its reliance on foreign loans and achieved greater fiscal autonomy. Nigeria, with its significant economic size and dynamic population, could follow a similar path but on a greater scale.

Nigeria’s economy has long been anchored in oil production, but the global transition to renewable energy is accelerating. This shift poses both risks and opportunities. Instead of clinging to an oil-dependent model, Nigeria could pivot toward a future focused on technology and innovation.

One actionable step could be selling off some of the nation’s less productive oil assets.

The proceeds from these sales could then be reinvested in Bitcoin. This strategy gives Nigeria the opportunity to diversify the national reserve with a deflationary digital asset, and signal to global markets that Nigeria is serious about embracing forward-looking financial policies.

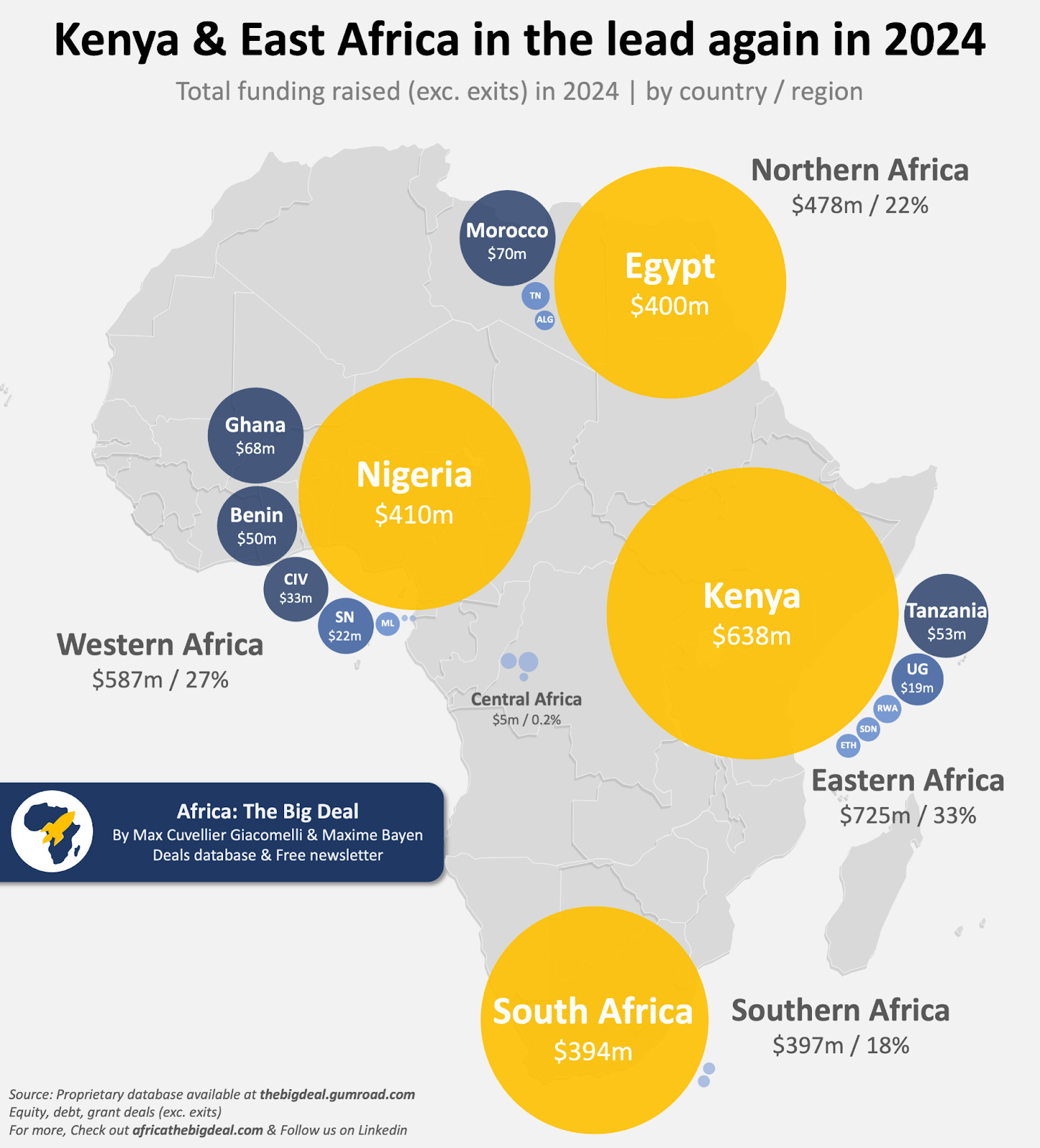

Nigeria is already the second largest destination for startup activity in Africa as of 2024.

Additionally, ranking second in global adoption, Nigeria received $59 billion in cryptocurrency value between July 2023 and June 2024 - including at retail, professional, and institutional levels.

Of transactions under $1 million, stablecoins are used most to transact in Nigeria, given high inflation in the country and a depreciating naira, however there were still billions of dollars in bitcoin transactions from 2022 to 2024.

Already a global leader in crypto adoption on a global scale, adopting a bitcoin strategy on a national level will automatically lead to the exploration and participation of the broader economy in Nigeria, so all else equal it seems like a no brainer.

A national bitcoin strategy for Nigeria would help to hedge inflation and currency devaluation and reduce dependency on foreign loans.

Foreign investment will follow, job creation will grow, and the economy can also begin to rely less on the volatile and fragile oil market.

Bitcoin already has a stamp of approval as a valuable asset from the whales of the world - who continue to be hungry for bitcoin. The amount of bitcoin held by U.S traded ETFs went from 650 000 bitcoins to 1 250 000 bitcoins in one year.

Additionally, through the approximately 200 000 bitcoin that the U.S. government has from asset seizures, President-elect Donald Trump has suggested creating a bitcoin national strategic reserve for the United States. Should that come to pass, would it not be beneficial for the Nigerian economy to be right alongside the United States as a fellow investor in bitcoin?

El Salvador showed us the blueprint for how bitcoin adoption can pull an economy out of a slump. In a previous letter I suggested that South Africa adopt a bitcoin strategy, and Nigeria should follow suit.

Obviously the problems in Nigeria are a lot more nuanced than what I’ve mentioned and there’s a whole lot more that I’m missing and yet to understand. I invite anyone with deeper insights relating to the topics in this letter to please reach out and share.

But the point of this letter is to highlight a shifting world view towards a technology that can and has proven to be a source of power to take an economy to unseen heights. That’s why BlackRock and Fidelity like this technology, that’s why El Salvador loves it, and that’s why the U.S. government is taking it seriously.

I hope you enjoyed reading this letter.

On my journey to becoming a master capital allocator, one lesson down, a billion more to go.

Hope you all have a great day.

-Mansa